CHAPTER SEVENTEENCorporate Close and Consolidation

INTRODUCTION: THE FISCAL CLOSING process represents a key corporate governance process and the ultimate set of controls over fiscal results. While transactions represent the results of operations, it is up to the finance and accounting organization to execute control reviews and analysis processes to validate transactional information, identify potential errors or misstatements, and put the seal of approval on financial results during the corporate close and consolidation processes.

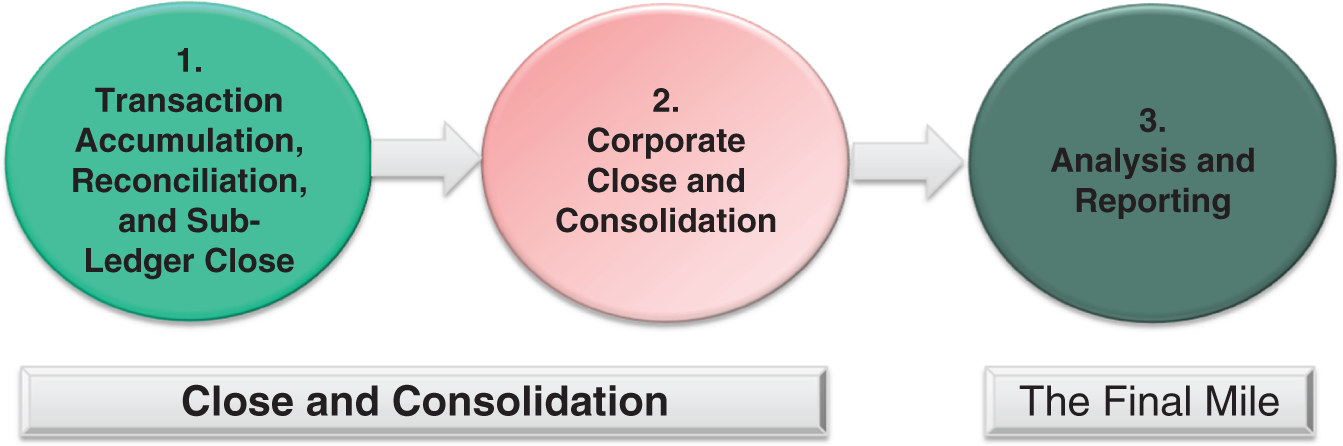

The Corporate Close and Consolidation process includes the close of business or operating units and includes the completion of the adjusted trial balance and the first pass of consolidated financial statements. This process is highlighted in the diagram below.

For many organizations, the number of information interfaces, period-end journal entries, validation and analysis activities, and consolidation of results equates to several hundred sequential steps performed to close the books, ideally in the fewest number of days possible in order to release results on a timely basis.

Typically, the word consolidated appears in the title of a fiscal statement, as in a consolidated balance sheet. A consolidation of a parent company and its majority-owned (more than 50% ownership or “effective control”) subsidiaries ...

Get The Fast Close Toolkit now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.