12.A TECHNICAL APPENDIX

We first test the relation between news arrivals and volatility of S&P/ASX 200 Index returns and SPI 200 Futures returns by estimating the following censored regression model:

![]()

in which |rt| is either the absolute value of the seasonally adjusted return of the S&P/ ASX 200 Index or the SPI 200 Futures at the tth interval, Nt is the number of all company announcements, and Vt-1 is the lagged de-trended trading volume. The lagged de-trended trading volume is also included to account for the potential that this variable does reflect to some degree the intensity of private information flows not accounted for by Nt. The results are obtained based on maximum likelihood estimation with the left-censoring point of 0 imposed on the dependent variable.

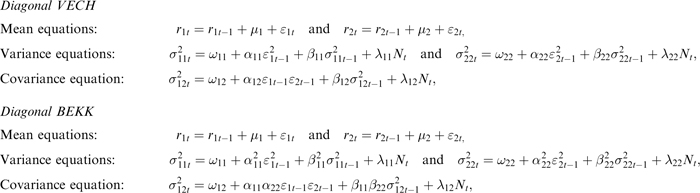

Table 12.6. Company news announcements and intraday conditional volatility of the S&P/ASX 200 Index and the SPI 200 Futures (multivariate GARCH results). The results are based on estimation of the following multivariate GARCH(1,1) model:

in which r1t and r2t are the seasonally adjusted returns of the S&P/ASX 200 Index and the SPI 200 Futures at the rth interval, ![]() and are conditional variances of the error processes

and are conditional variances of the error processes

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.