Chapter Seven

A Balancing Act

Outperforming the Market while Taking Less Risk

The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.

—Paul Tudor Jones

As discussed throughout this Little Book, hedge funds have a broad mandate and offer investors access to various alternative investment strategies so that they may generate a return that has a low correlation to equity markets. They are able to employ a diverse range of investing strategies so that they can hedge their investments to increase gains and offset losses. The goal is to make sure that under all different types of scenarios the manager can stem losses and generate gains.

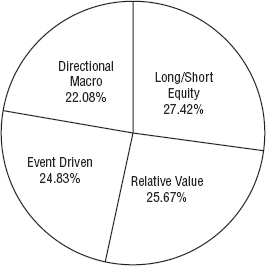

This chapter is about the various hedge funds strategies managers use to generate absolute returns regardless of market conditions. Just as there are numerous definitions for hedge funds, there are also various strategy classifications that are further subdivided into different classes. For the purpose of this chapter, we will classify hedge funds in the following four categories (see Figure 7.1):

Figure 7.1 Hedge Fund Strategies

1. Long/Short Equity

2. Relative Value

3. Event Driven

4. Directional

For the purposes of this Little Book, I will list the various subdivisions that are classified within each category; however, we will only discuss certain ...