Chapter SixDividends Are the Investor’s (Best?) Friend

But Mutual Funds Confiscate Too Much of Them.

DIVIDEND YIELDS ARE A vital part of the long-term return generated by the stock market. In fact, since 1926 (the first year for which we have comprehensive data on the S&P 500 Index), dividends have contributed an average annual return of 4.2 percent, accounting for fully 42 percent of the stock market’s annual return of 10.0 percent for the period.

An astonishing revelation.

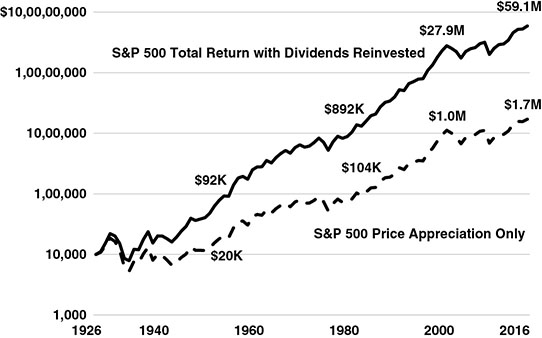

Compounded over that long span, dividends made a contribution to the market’s appreciation that is almost beyond belief. Excluding dividend income, an initial investment of $10,000 in the S&P 500 on January 1, 1926, would have grown to more than $1.7 million as 2017 began. But with dividends reinvested, that investment would have grown to some $59.1 million! This astonishing gap of $57.4 million between (1) market price appreciation alone and (2) total return when dividends are reinvested simply reflects (once again) “the magic of cost-free compounding” (Exhibit 6.1).

EXHIBIT 6.1 S&P Price Return versus Total Return

The stability of the annual dividends per share of the S&P 500 is truly remarkable (Exhibit 6.2). Over the 90-year span beginning in 1926, there were only three significant drops: (1) a 55 percent decline during the first years of the Great Depression (1929–1933); (2) a 36 percent decline ...

Get The Little Book of Common Sense Investing, Updated and Revised now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.