2

Why the Recovery Has Been So Weak

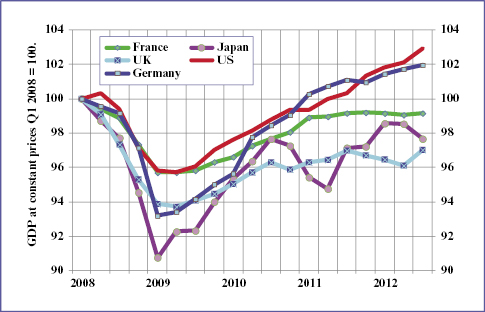

We are now suffering from a weak and halting recovery. Chart 1 shows that among G5 countries only in Germany and the US has real GDP risen above the level that was achieved in the first quarter of 2008. Both the UK and the US provide examples of how unusual the recession has been, both in terms of the slowness of the recoveries and in the depths of the downturns. It has taken longer to recover to the previous peak in real GDP than on any previous occasion since World War II. Indeed, there are claims that the UK recovered more quickly in the 1930s than it has after the recent recession.1 The US took four years from Q4 2007 to Q4 2011 to recover to its previous peak and the UK after four and half years has still not recovered to its Q1 2008 peak. In both countries the loss of output from peak to trough was the greatest seen in the post-war period, amounting to 6.3% of GDP for the UK and 4.7% for the US.2

Chart 1. The Weak Recovery of G5 Countries.Sources: National Accounts via Ecowin.

The weak recovery has occurred despite the most aggressive attempt at stimulating the economy, in terms of both fiscal and monetary policy, that has been tried since World War II.

Interest rates were kept low in wartime, but then rose and have now fallen back to their lowest post-war level in nominal terms (Chart 2).

Chart 2. US: Interest Rates & Bond Yields.Sources: ...

Get The Road to Recovery: How and Why Economic Policy Must Change now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.