3

Alternative Explanations for Today's Low Business Investment and High Profit Margins

The trend decline in business investment can be explained by the change in the way that management is paid, but there are other possible causes.

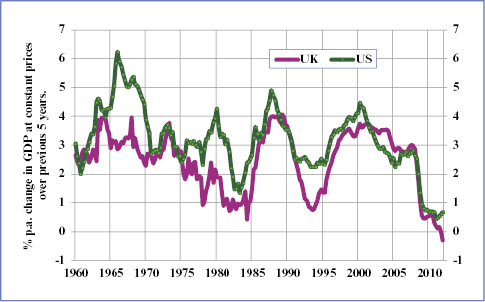

It may have been due to declining confidence in the prospects for growth. This cannot be measured, but until the financial crisis confidence about the growth of both economies was generally thought to be high. Chart 35 shows that, while growth was quite volatile and seemed to be trending downwards a bit in the US, there was no apparent reason to take a dim view of prospects before the financial crisis in either the UK or the US.

Chart 35. UK & US: 5-year Growth Rates.Sources: ONS & NIPA.

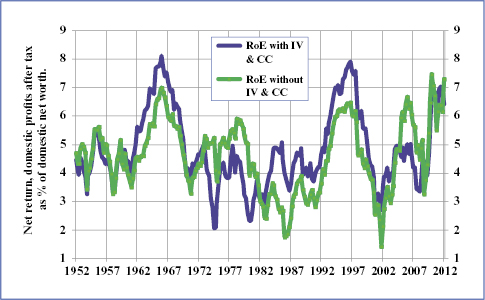

Another possible reason is that the returns on investment may have fallen. The return after tax on net worth in the US is shown in Chart 36. Using either of the two definitions of profits used by the US national accountants, the domestic profitability of US companies was 40 or 67% above average in Q1 2012.1

Chart 36. US: Return, Net of Tax, on Net Worth of Non-financial Companies.Sources: Z1 Tables B.102 & L.102 & NIPA Table 1.14.

UK returns on capital are not as high as they are in the US, but as Chart 37 illustrates they show no sign of being under pressure despite the ...

Get The Road to Recovery: How and Why Economic Policy Must Change now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.