4

Forecasting Errors in the UK and the US

Additional evidence for the importance of the change in management remuneration is provided by the way in which those forecasters who have ignored the change have made exactly those errors in their forecasts that they would have avoided had they made allowance for the way in which the behaviour of companies has altered.

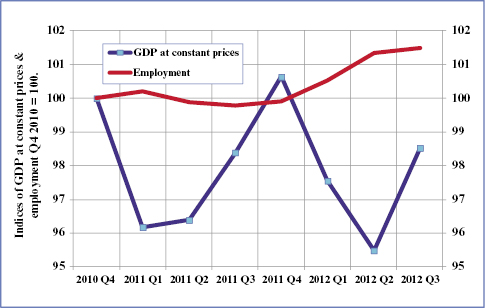

In his recent revision to previous forecasts, Robert Chote, who is Chairman of the UK's Office for Budget Responsibility (OBR), expressed surprise that inflation had been higher than he had expected and investment weaker. The Bank of England has also been persistently too optimistic about inflation and output. In its Inflation Report of November 2012, it discusses the way that employment had risen unexpectedly fast compared with output, so that productivity has been poor. As Chart 42 shows, measured from Q4 2010, the output of the UK has fallen but employment has risen so that productivity, measured as output per person employed, has fallen by 3%.

Chart 42. UK: Output & Employment.Source: ONS via Ecowin.

In the previous forecast to which Robert Chote referred, the OBR had expected that the UK economy would grow by 5.7% from Q1 2010 to Q2 2012, whereas the outturn has been only 0.9%. Consumer spending, business investment and net exports were all weaker than expected and “all contributed roughly equally to the unexpected weakness ...

Get The Road to Recovery: How and Why Economic Policy Must Change now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.