7

Japan Has a Similar Problem with a Different Cause

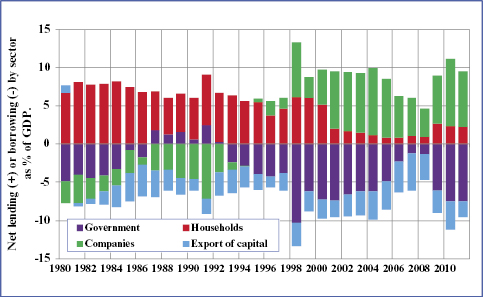

Japan is similar to the UK and the US in that its corporate sector is also running a large cash flow surplus. As Chart 59 shows, prior to 1993 Japan's business sector habitually ran a cash deficit, as it invested more each year than it saved through the combined resources of depreciation and retained profits. Since 1995 it has persistently run a cash surplus and this amounted to 7.5% of GDP in 2011 which matched nearly all the fiscal deficit of 9.7% of GDP.1

Chart 59. Japan: Sector Cash Flows.Sources: Cabinet Office data for 1980 to 2000 are from the National Accounts for 2003 & for 2001 to 2011 from the National Accounts for 2011.

In Japan's case, however, the reason for the corporate sector's cash surplus is very different from that of the UK and the US. The main problem in Japan arises from the amount that companies are allowed for tax calculations to deduct from their profits for depreciation. There is no evidence that management remuneration has changed in a way that has changed business behaviour and Japan's problem thus had a different origin from that of the UK and US.

As Chart 60 shows, depreciation was sufficient to finance less than half of Japanese companies' investment spending in the 1950s, but since 2010 depreciation has covered more than 100% of their capital expenditure. This means that companies don't need any ...

Get The Road to Recovery: How and Why Economic Policy Must Change now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.