Chapter 20 The Role of the Quantitative Analyst

Quantitative analysts are better known as quants. They perform a vital role in most capital market organisations but are often regarded as quite different by virtue of their personalities and interactions with other business functions. Their work is little understood by the wider world, but here we try to unveil some of the mystery that surrounds the quants.

20.1 What is a quant?

A quant is generally someone with a high level of mathematical knowledge and aptitude. He or she uses his or her skills to develop mathematical calculations. Here are some common individual tasks that a quant might do in the course of a regular working day:

- Answering questions such as ‘What's the yield on this instrument?’

- Pricing a single trade

- Calculating risk measures

- Developing methodology to analyse a type of product

- Implementing methodology (writing code)

- Analysing a competitor's product – how does it work and how is it hedged?

- Getting product approval for a new product range

- Ensuring that another quant's model is accurate and compliant.

20.2 Where do quants work?

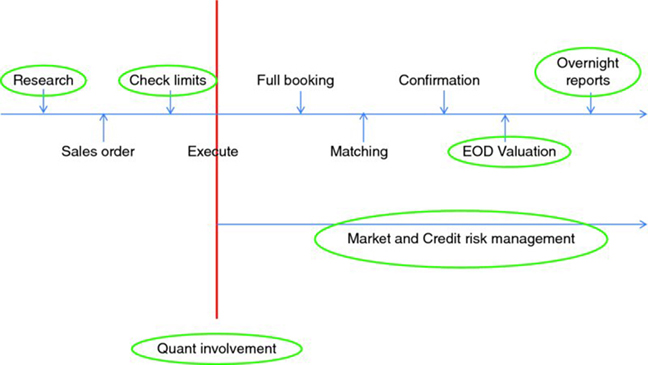

Figure 20.1 shows the points in the trade lifecycle where a quant may be involved (the circled text).

Figure 20.1 Position of quants in trade lifecycle

Not every quant will be involved in every function. As in all professions, quants tend to specialise in one or two areas, so ...

Get The Trade Lifecycle: Behind the Scenes of the Trading Process, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.