Appendix A

The Varieties of Debt

It’s important to gain a general understanding of the different types of debt that are out there and available to you. While this is less of a specific Strategic Debt Practice or application and more of a meta-practice or big picture practice, it is nonetheless very important, because it relates to and underlies all of the other practices. For example, the answer to whether to pay down a certain type of debt often depends on which kind of debt it is, and while achieving and maintaining an ideal debt ratio is very important, once again, you don’t want to make that happen by taking on the wrong kind of debt.

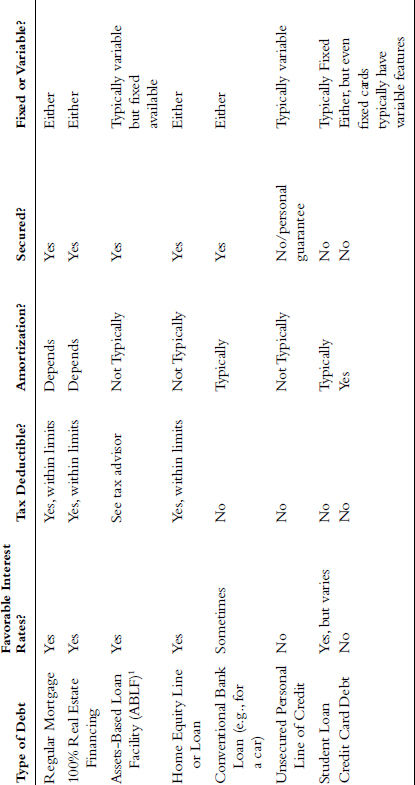

To this end, Table A.1 lists the major types of debt that you as an individual or family are likely to have access to, along with a number of characteristics of that debt.

Table A.1 Types of Debt and Characteristics

The far left column on the chart lists the different types of debt, and then for each type of debt the following characteristics are considered:

- Favorable Interest Rates?—Are the rates associated with this kind of debt usually good ones?

- Tax Deductible?—Debt that comes from a loan where the interest is tax deductible is very desirable. Depending on your tax bracket, the real cost of such a loan can be substantially less than the nominal interest rate you are paying. You will want to be sure you understand limits to deductions and if ...

Get The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.