Appendix D

Some Examples of Ideal Debt Ratios*

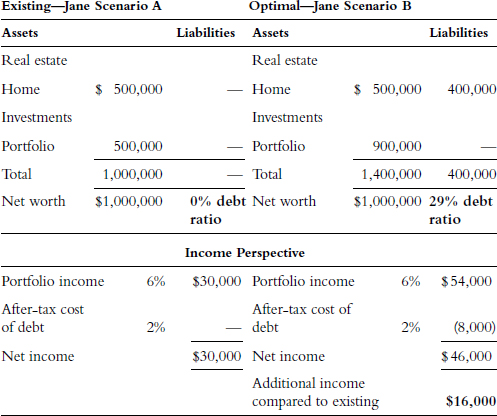

This appendix will help to frame the concept of optimal by sketching out what a number of different optimal debt ratios look like in practice. Since some of these materials are a bit more advanced, we will use the same format we used at the end of Chapter 5, which is to lay out two balance sheets in a side-by-side comparison. We will start out with a review of a case study from Chapter 5 and then continue on to increasingly more advanced scenarios and concepts.

Scenario 1: “I’m an Accumulator—No Debt for Me!”

(This is the same scenario for Jane earlier reviewed in Chapter 5.)

In the optimal scenario, on the right of Table D.1, Jane

Table D.1 Scenario 1: “I'm an Accumulator—No Debt for Me!”

- Generates $16,000 more per year in income, which is equivalent to increasing her rate of return by 53.3 percent.

- Gets a significant tax deduction (the benefit of this is accounted for in her after-tax cost of debt).

- Is eligible for an ABLF that is 80 percent higher and likely priced at a lower rate.

- Is not subject to a forced margin call because her debt is structured against her home.

- Can pay off her debt anytime she doesn’t like this strategy.

If Jane reinvests the additional $16,000 at the same 6 percent for five years, she will generate a total of approximately $90,000 in additional value versus the no-debt scenario on the left.

Looking forward: ...

Get The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.