The Hybrid Advice Model

By Tobias Henry

Digital Wealth Lead – Managing Principal, Capco

In its simplest form, the hybrid approach combines the best components of human-based financial advice and digital advice, offering a flexible and tailored wealth management solution to clients of all demographics.

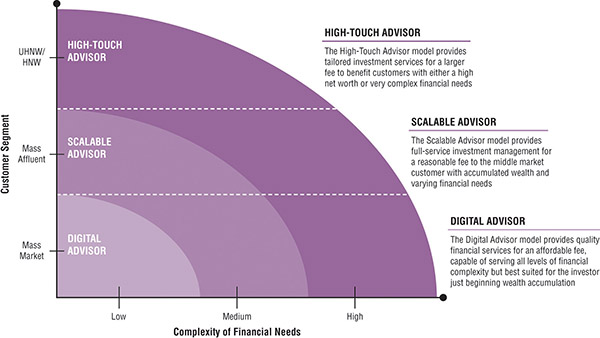

The hybrid advice solution is underpinned by a flexible business model that can support customers throughout their financial lives, from mass market to ultra-high net worth. The hybrid approach, as shown in Figure 1, has three models to offer customers, depending on their customer segment (defined by investable assets) and the complexity of their financial needs.

Figure 1: The hybrid advice model

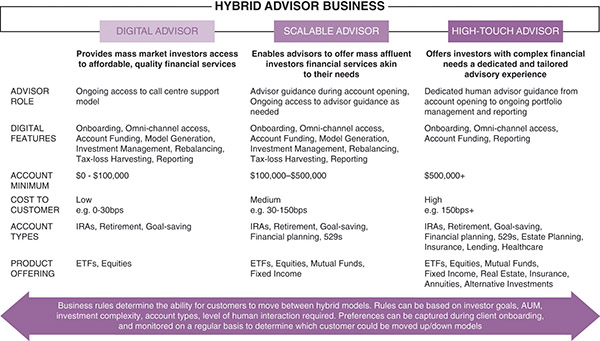

The level of human interaction, product complexity, fees and accounts offered change between business models. The business models shown in Figure 2 indicate the optionality of the solution and illustrate the flexibility of the hybrid approach to meet the needs of all customer segments and financial needs.

Figure 2: Optionality and flexibility of the hybrid model

Notes: BPS = basis points; IRA = individual retirement account; ETF = exchange traded fund

The hybrid model has many inherent benefits to the financial advisor, the business and the client that make it an attractive and ...

Get The WEALTHTECH Book now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.