Chapter 9

Anticipating the Signal

Patience is a high virtue.

—Geoffrey Chaucer

One of the most prevalent and destructive breakdowns in trader discipline arises from attempting to anticipate the signal. This chapter examines the allure of historically high or low prices and how focusing on price history leads speculators to abandon positive expectancy trading models. Particular emphasis is placed on the development of psychological tools to promote patience and discipline in the face of historically unprecedented prices.

ALWAYS TRADE VALUE, NEVER TRADE PRICE

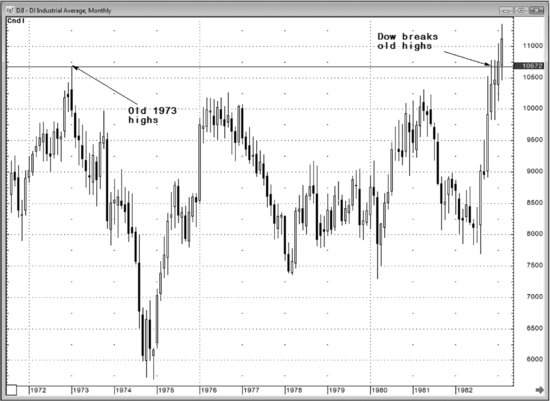

You've heard it before: Buy low and sell high. Although on the surface it seems simple, logical, and self-evident, it is deceptive and has led to fantastic losses for countless traders because no one knows what a high or low price is while markets are moving to unprecedented historical price levels. When I wrote these words in 2011, 1,067.2 seemed like a low price for the Dow Jones Industrial Average, but in 1982 it was the highest level ever recorded (see Figures 9.1 and 9.2). The truth of historically high prices seeming low in retrospect (and vice versa) led me to develop my own cliché regarding high and low prices: Always trade value, never trade price.

Figure 9.1 Quarterly Cash Dow Jones Industrial Average Chart Breaks to All-Time New Highs in 1982

Source: CQG, Inc. © 2010. All rights reserved worldwide.