5.6. BOTTOM-FISHING WITH POCKET PIVOTS

Some pocket pivots can occur as stocks that have corrected and declined a significant amount finally "hammer out" a bottom after several weeks or months of base-building along the lows of the decline. The severe market break that began in September 2008 took a lot of former "big stock" leaders from the immediately preceding bull phase down sharply. Some of these stocks eventually declined over 70 percent or more from their bull market price peaks, at which point they began to stabilize and probe for potential bottoms. After several weeks or months the stock will have finally started to "round out" a potential bottom. It is at this point that investors should be alert to potential pocket pivots as they will often show up in a stock that is potentially coming up off its lows and ready to stage some sort of material rally off the bottom.

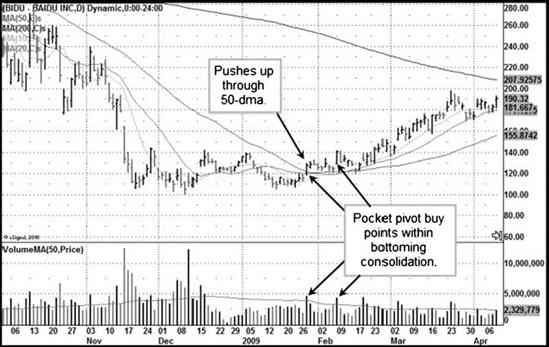

Figure 5.22. Baidu, Inc. (BIDU) daily chart, 2009 market bottom. Two pocket pivot buy points mark the start of a "bottom-fishers rally" in the stock.: Chart courtesy of eSignal, Copyright 2010

Baidu, Inc. (BIDU) was one such former leader that declined 73.8 percent off of its bull market price peak and by late November 2008 was trying to probe for a bottom (Figure 5.22). This process went on for the next two months before the stock was finally able to regain its 50-day moving average on a pocket pivot buy point ...

Get Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.