CHAPTER 9

Momentum and Oscillators

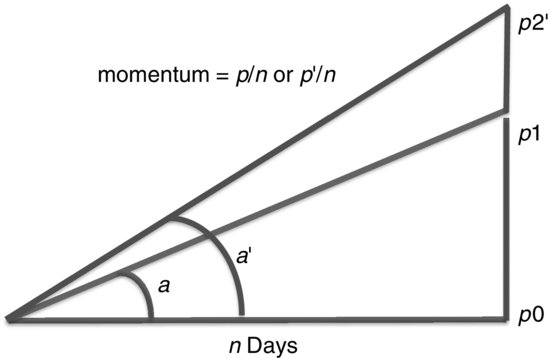

The study of momentum and oscillators is the analysis of price changes rather than price levels. Among technicians, momentum establishes the speed of price movement and the rate of ascent or descent. Analysts use momentum interchangeably with slope, the angle of inclination of price movement usually found with a simple least squares regression (Figure 9.1). In mathematics it is also the first difference, the difference between today’s price and the previous day. Momentum is often considered using terms of Newton’s Law, which can be restated loosely as once started, prices tend to remain in motion in more-or-less the same direction.

Figure 9.1 Geometric representation of momentum.

Indicators of change, such as momentum and oscillators, are used as leading indicators of price direction. They can identify when the current trend is no longer maintaining its same level of strength; that is, they show when an upwards move is decelerating. Prices are rising, but at a slower rate. This gives traders an opportunity to begin liquidating their open trend trades before prices actually reverse. As the time period for the momentum calculation shortens, this indicator becomes more sensitive to small changes in price. It is often used in a countertrend, or mean reversion strategy. The change in momentum, also called rate of change, acceleration, or second difference ...

Get Trading Systems and Methods, + Website, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.