Chapter 5

Volume Is Money

Commitment to Prices

Another indicator that is overused, and sometimes incorrectly, is volume. Much noise is heard everyday about volume and how the tea leaves can be read. Volume is part of our analytical process but it is just a tool. I think of volume as a secondary indicator. Our primary indicator of when to take a trade is always the price. The analysis of volume is in the past but is never a part of the in-the-moment decision process, with one possible exception. At the time of the trade, you are part of the volume that is influencing price.

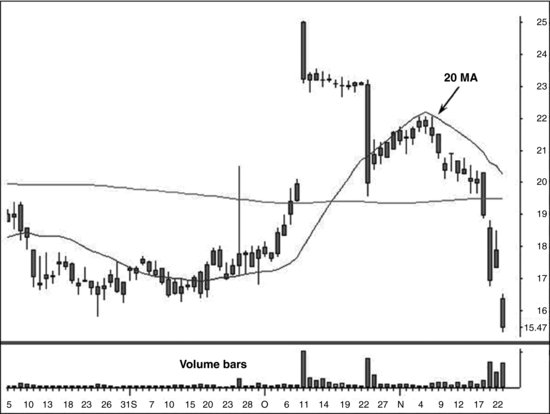

In its basic form, volume indicates a commitment, or lack thereof, to current prices. It can be useful as a confirming indicator to candlestick patterns. But I cannot emphasize enough that it is price action and its patterns that are the reason for any trade, never volume alone. Just because volume is rising or falling does not give us any objective information by itself. It is the candlesticks that reveal the supply and demand relationship. Volume just tells the magnitude of that relationship. See Figure 5.1.

Figure 5.1 Volume Is One of Three Things You Should Have on Your Chart

Chart courtesy of Mastertrader.com.

Volume is perhaps one of the most talked about indicators in trading. Volume earns a unique distinction with me. On one hand, it is one of the three important things that I keep on my charts. Remember, ...