Chapter 11

Shoot the Gap

What Is a Gap?

Gaps are a category unto themselves. They are unique because whatever caused the gap often follows into the trading day and can create high-volume, large trading swings, and a stock that often ignores what the market is doing. This combination of events can often make for excellent trading opportunities. Before we get into the possible opportunities, we have to define just what a gap is, discuss the many fallacies about gaps, and then look at gaps both on a daily chart, and on and intraday basis.

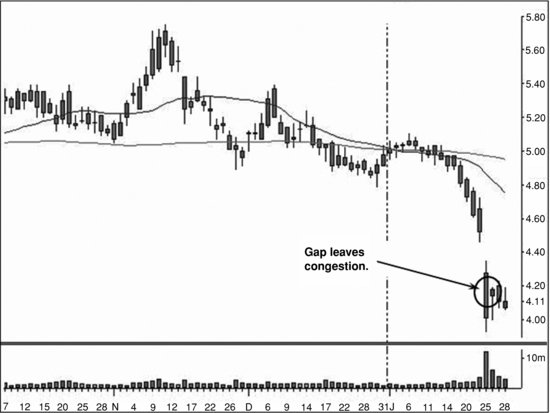

The word gap refers to the space that is left behind on the daily chart. It is the empty space between one day's close and the next day's open. Although this is where the word gap got its meaning, stocks can also gap into the prior day's trading range, leaving congestion behind rather than a gap. These are not as obvious to see on a daily chart. Gaps can be either up or down. They can happen to all stocks, as well as markets. You can see the different looks that these two types of gaps have in Figures 11.1 and 11.2.

Figure 11.2 This Gap Leaves Congestion behind on the Daily Chart

Chart courtesy of Mastertrader.com.

A gap is what we have on the chart ...