22 Evaluating Trading Strategies

Campbell R. Harvey Yan Liu

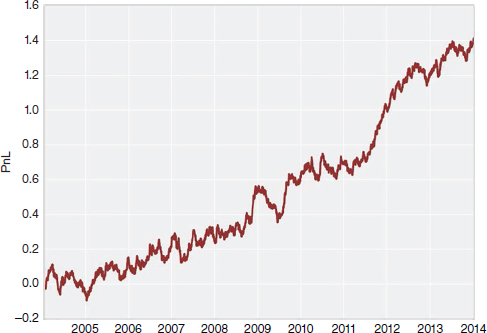

Consider the following trading strategy detailed in Figure 22.1.1 While there is a minor drawdown in the first year, the strategy is consistently profitable through 2014. Indeed, the drawdowns throughout the history are minimal. Importantly, the strategy even does well during the financial crisis. Overall, this strategy appears very attractive and many investment managers would pursue this strategy.

FIGURE 22.1 A Candidate Trading Strategy

Our research (see Harvey and Liu, 2014 and Harvey, Liu, and Zhu, 2014) offers some tools to evaluate strategies such as the one presented in Figure 22.1. It turns out that simply looking at average profitability, consistency, and size of drawdowns is not sufficient to give a strategy a passing grade.

Testing in Other Fields of Science

Before presenting our method, it is important to take a step back and determine whether there is anything we can learn in finance from other scientific fields. While the advent of machine learning is relatively new to investment management, similar situations involving a large number of tests have been around for many years in other sciences. It makes sense that there may be some insights outside of finance that are relevant for finance.

Our first example is the widely heralded discovery of the Higgs Boson in 2012. The particle was first theorized ...

Get Trend Following, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.