Appendix CLevering and Unlevering the Cost of Equity

This appendix derives various formulas that can be used to compute unlevered beta and the unlevered cost of equity under different assumptions. Unlevered betas are required to estimate an industry beta, as detailed in Chapter 15. We prefer using an industry beta rather than a company beta to determine the cost of capital because company betas cannot be estimated accurately. As discussed in Chapter 10, the unlevered cost of equity is used to discount free cash flow to compute adjusted present value. For companies with substantial postretirement obligations, the appendix concludes by incorporating pensions and other postretirement benefits into the unlevering process.

Unlevered Cost of Equity

Franco Modigliani and Merton Miller postulated that the market value of a company’s economic assets, such as operating assets (Vu) and tax shields (Vtxa), should equal the market value of its financial claims, such as debt (D) and equity (E):

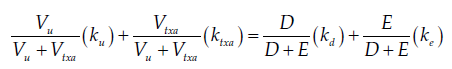

A second result of Modigliani and Miller’s work is that the total risk of the company’s economic assets, operating and financial, must equal the total risk of the financial claims against those assets:

where

The four terms in this equation represent the proportional risk of operating ...

Get Valuation, 7th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.