Appendix C

Answers to Selected End-of-Chapter Problems

CHAPTER 2

- 2.1. After-tax cash flow = $135, 000.

- 2.4.

- Applying the comparable EBITDA multiple to Fleet's 2004 EBITDA yields: 56.7 × 6 = $340 million.

- Cost of debt = 7%, cost of equity = 4.5% + (1.32)(4.4%) + 3.9% = 14.4%, WACC = 9.27%.

- 2.5. Cost of equity = 4.5% + (0.66)(4.4%) + 3.9% = 11.3%.

- 2.8.

- (b)

Enterprise value $1,198.4 million Debt 650.0 Equity 548.4 Shares 35 Value per share $15.67 - (c)

- (b)

- 2.11. EPS2013 = (0.99)(1.185)5(1.09)5 = $3.6

Dividend2014 = (0.51)(3.6)(1.04) = $1.9

Share value2013 = 1.9/(0.10 − 0.04) = $31.7

Share value2002 = $31.7/(1.12)10 = $10.2.

CHAPTER 3

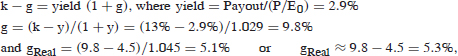

- 3.3. Required return on the S&P 500 index: k = 9% + (4%)(1) = 13.0%.

- P/E0 = Payout (1 + g)/(k − g) or

versus a compound growth rate of earnings during the post-war period of about 2%.

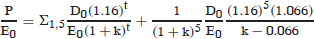

- The long-term nominal growth of earnings and dividends would be about (1.02)(1.045) − 1 = 6.6%. Hence,

where D0/E0 = 0.614 and P/E0 = 21.2. Solving for k, it ...

- P/E0 = Payout (1 + g)/(k − g) or

Get Valuation for Mergers, Buyouts, and Restructuring, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.