2

The Core of Value

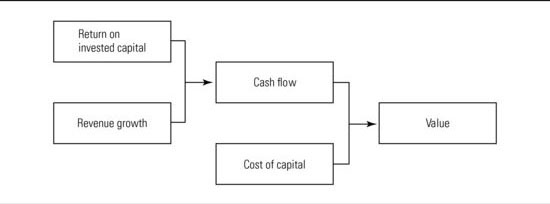

Companies create value for their owners by investing cash now to generate more cash in the future. The amount of value created is the difference between investments made and cash inflows—adjusted for the fact that tomorrow's cash flows are worth less than today’s, due to the time value of money and riskiness of future flows. As we demonstrate later, a company's return on invested capital (ROIC),1 and its revenue growth, determine how revenues get converted into cash flows. Therefore, value creation is ultimately driven by ROIC, revenue growth and, of course, the ability to sustain both over time. This first cornerstone, the core of value, is illustrated by Exhibit 2.1.

EXHIBIT 2.1 Growth and ROIC Drive Value

One might expect universal agreement on how to measure and manage value, but this isn't the case—as many executives, boards, and journalists still focus almost obsessively on earnings and earnings growth. Although earnings and cash flow are usually correlated, they don't tell the whole story of value creation, and focusing too much on earnings often leads companies astray.

Earnings growth alone can't explain why investors in two successful, but different, companies like Walgreens and Wm. Wrigley Jr. earned similar shareholder returns between 1968 and 2007, despite much different growth rates. During the period, the drugstore chain (Walgreens) had a growth ...