APPENDIX AProbability

The mathematics that underly options theory can appear imposing. However, the real challenges in practical options trading and risk management are conceptual, not mathematical. I do presume some exposure to undergraduate‐level probability, statisics, and calculus. However, this appendix is written to provide a refresher on these topics via simple, example‐based explanations of the mathematical concepts in the main text for readers who may have lost familiarity with these topics over the course of time. This appendix should be sufficient to keep this textbook self‐contained.

A.1 PROBABILITY DENSITY FUNCTIONS (PDFS)

A.1.1 Discrete Random Variables and PMFs

Before studying PDFs, let us begin with probability mass functions (PMFs). PMFs provide a helpful introduction to PDFs, because they are the discrete state analogs of PDFs.

The EUR‐USD spot rate at a future time ![]() ,

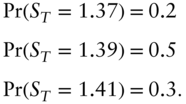

, ![]() , is a random variable. Suppose that it can take one of three discrete values, 1.37, 1.39, and 1.41. Suppose also that the probabilities with which these values occur are

, is a random variable. Suppose that it can take one of three discrete values, 1.37, 1.39, and 1.41. Suppose also that the probabilities with which these values occur are

The PMF belonging to ![]() is ...

is ...

Get Volatility now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.