Module 36: Transactions in Property

PROPERTY TRANSACTIONS

Realized Gain or Loss

Amount realized

| − | Adjusted basis |

| = | Realized gain or loss |

Amount Realized

Cash received

| + | FMV of property received |

| + | Net debt relief |

| − | Direct selling expenses |

| = | Amount realized |

Net debt relief = Liabilities transferred − Liabilities assumed

Adjusted Basis

Initial basis

| + | Improvements |

| − | Depreciation |

| − | Costs recovered |

| ± | Adjustments |

| = | Adjusted basis |

| Initial Basis | |

| Property converted from personal use to business or investment use to business or investment use | Lower of actual basis or FMV on date of conversion |

| Inherited property | FMV at date of death or alternate valuation date (date of distribution up to six months after death) |

| Property received as gift | Gain = Same as donor's basis (transferred basis) Loss = Lesser of (a) gain basis, or (FMV) at date of gift |

Sec. 1245 Depreciation Recapture

Applies to the disposition of depreciable personal property (e.g., trucks, autos, machinery, equipment)

Realized gain

| − | Depreciation recapture (treated as ordinary income) |

| = | Section 1231 gain |

Amount of depreciation recapture

- Realized gain < accumulated depreciation, use amount of gain

- Realized gain ≥ accumulated depreciation, use accumulated depreciation

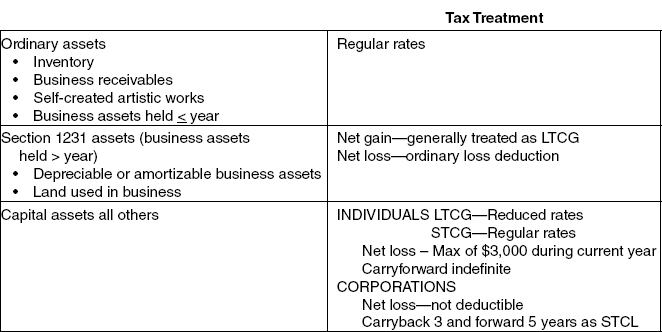

Taxation of Gains and Losses

Related-Taxpayer Transactions

Related taxpayers include

- Taxpayer's spouse, brothers, ...

Get Wiley CPAexcel Exam Review 2014 Focus Notes: Regulation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.