Focus on: Leases—Module 13

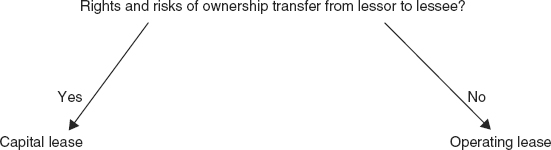

ACCOUNTING FOR LEASES

Lessee Reporting

Transfer of Rights and Risks of Ownership—At least one of four criteria

Actual transfer

- Title transfers to lessee by end of term.

- Lease contains bargain purchase option.

Transfer in substance

- Lease term ≥ 75% of useful life.

- Present value of minimum lease payments ≥ 90% of fair market value.

To calculate present value, lessee uses lower of:

- Incremental borrowing rate.

- Rate implicit in lease (if known).

Capital Leases

Inception of Lease

Journal entry to record lease:

| Leased asset | xxx |

Lease obligation |

xxx |

Amount of asset and liability = Present value (PV) of minimum lease payments:

- Payments beginning at inception result in annuity due.

- Payments beginning at end of first year result in ordinary annuity.

- Payments include bargain purchase option or guaranteed residual value (lump sum at end of lease).

Lease payments

Payment at inception:

| Lease obligation | xxx |

Cash |

xxx |

Subsequent payments:

| Interest expense | xxx |

| Lease obligation | xxx |

Cash |

xxx |

Interest amount:

Periodic Expenses—Depreciation

Actual transfer (first of first two criteria)

- Life = Useful life of property

- Salvage value taken into consideration

Transfer in substance (first of latter two criteria) ...

Get Wiley CPAexcel Exam Review 2014 Focus Notes: Financial Accounting and Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.