CHAPTER 7

THE FEDERAL AUDIT MODEL

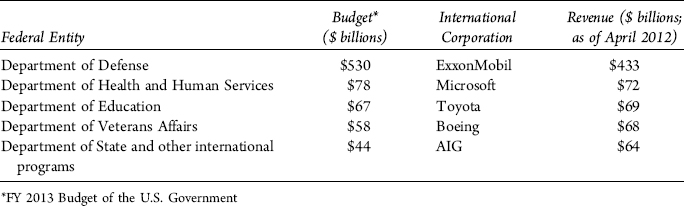

The Federal audit model has many similarities to its commercial counterpart; however, it has just as many significant differences. It is imperative that an auditor be properly trained in the Federal accounting and reporting environment in order to effectively execute a Federal audit. The size of Federal entities is equivalent to the largest of international corporations. No auditor without sufficient training would ever attempt to audit any of these corporate entities.

Second, the hierarchy of generally accepted accounting principles (GAAP) is unique for Federal entities. The Federal Accounting Standards Advisory Board (FASAB) was designated as the accounting standards-setting body for Federal entities under Rule 203 of the Code of Professional Conduct of the American Institute of Certified Public Accountants (AICPA) in 1999. FASAB defined the hierarchy of GAAP in the Statement of Federal Financial Accounting Standards (SFFAS) 34, The Hierarchy of Generally Accepted Accounting Principles for Federal Entities, Including the Application of Standards Issued by the Financial Accounting Standards Board, in 2009. An auditor must be familiar with this hierarchy and all FASAB pronouncements in addition to laws, regulations, and Office of Management and Budget (OMB) and Government Accountability Office (GAO) guidance in order to audit in the Federal environment. ...

Get Wiley Federal Government Auditing: Laws, Regulations, Standards, Practices, and Sarbanes-Oxley, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.