Building a Better Middleman

Flex your brain, not your market muscle

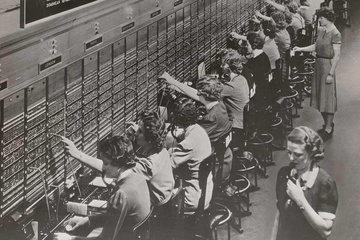

Photograph of Women Working at a Bell System Telephone Switchboard, circa 1945. (source: The U.S. National Archives on Flickr)

Photograph of Women Working at a Bell System Telephone Switchboard, circa 1945. (source: The U.S. National Archives on Flickr)

In the previous article, I explored the role of the middleman in a two-sided marketplace. The term “middleman” has a stigma to it. Mostly because, when you sit between two parties that want to interact, it’s easy to get greedy.

Greed will bring you profits in the short term. Probably in the long term, as well. As a middleman, though, your greed is an existential threat. When you abuse your position and mistreat the parties you connect–when your cost outweighs your value–they’ll find a way to replace you. Maybe not today, maybe not tomorrow, but it will happen.

Luckily, you can make money as a middleman and still keep everyone happy. Here’s how to create that win-win-win triangle:

Keep refining your platform

Running a marketplace is a game of continuous improvement. You need to keep asking yourself: how can I make this better for the people who interact through the marketplace?

To start, you can look for ways to make your platform more attractive to existing customers. I emphasize both customers, not just one side of the marketplace. Mistreating one side to favor the other may work for a time, but it will eventually fall through. Frustration has a way of helping people overcome switching costs.

Some stock exchanges designate market makers (“specialists,” if you’re old-school), firms that are always ready to both buy and sell shares of a given stock. If I want to offload a thousand shares and there’s no one who wants to buy them from me, the market maker steps in to play the role of the buyer. By guaranteeing that there will always be someone on the other side of the bid or ask, exchanges keep everyone happy.

If you constantly review how the two parties interact, you can look for opportunities to mitigate their risk, create new services, or otherwise reduce friction. Most platforms connect strangers, right? So if you look at your business through the lens of safety, you’ll find a lot of work to do. Note how eBay’s review system provides extra assurance for buyers and sellers to trade with people they’ve never met. Similarly, in the early days of online commerce, credit card issuers limited shoppers’ fraud risk to just $50 per purchase. This improved consumers’ trust in online shopping, which helped make e-commerce the everyday norm that it is today.

Safety improvements also extend to communications. Do the parties really need to swap e-mail addresses or phone numbers? If they’re just confirming a rideshare pickup or flirting through a dating app, probably not. As a middleman, you are perfectly positioned to serve as the conduit; one that provides an appropriate level of masking or pseudonymity. And the money you invest in deploying a custom messaging system or temporary phone numbers (Twilio, anyone?) will pay off in terms of improved adoption and retention.

Design new products and services

If you understand how your parties interact and what they want to achieve, you’re in a position to spot new product opportunities that will make your customers happy.

From a conversation with Cyril Nigg, Director of Analytics at Reverb, the music-gear marketplace was “founded by music makers, for music makers.” Musicians like to try new gear, but they want to offload it if it doesn’t pan out. Reverb has therefore built tools around pricing assistance to help musicians with their product listings: You want to sell this distortion pedal within 7 days? List it as $X. This extra assurance that they’ll be able to resell a piece of equipment, in short order, reduces apprehensions about buying. (Going back to the point about keeping both sides of the marketplace happy: Cyril also pointed out that a Reverb customer may act as both buyer and seller across different transactions. That means the company can’t skimp on one side of the experience.)

People on a dating site want to communicate, so an easy win there is to keep an eye on new communications tools. Maybe your platform started out with an asynchronous, text-based tool that resembled e-mail. Can you add an option for real-time chat? What would it take to move up to voice? And ultimately, video? Each step in the progression requires advances in technology, so you may have to wait before you can actually deploy something. But if you can envision the system you want, you can keep an eye on the tech and be poised to pounce when it is generally available.

Unlike dating sites, financial exchanges are marketplaces for opposing views. One person thinks that some event will happen, they seek a counterpart who thinks that it will not, and fate determines the winner. This can be as vanilla as people buying or selling shares of stock, where the counterparties believe the share price will rise or fall, respectively. You also see situations that call for more exotic tools. In the lead-up to what would become the 2008 financial crisis, investors wanted to stake claims around mortgage-backed securities but there wasn’t a way to express the belief that those prices would fall. In response to this desire, a group of banks dusted off the credit default swap (CDS) concept and devised a standard, easily-tradable contract. Now there was a way for people to take either side of the trade, and for the banks to collect fees in the middle. A win-win-win situation.

(Well, the actual trade was a win-win-win. The long-term outcome was more of a lose-lose-win. Mortgage defaults rose, sending prices for the associated mortgage-backed securities into decline, leading to big payouts for the “I told you this was going to happen” side of each CDS contract. The banks that served double-duty as both market participant and middleman took on sizable losses as a result. Let this be a lesson to you: part of why a middleman makes money is precisely because they have no stake in the long-term outcome of putting the parties together. Stay in the middle if you want to play it safe.)

Granted, you don’t have to roll out every possible product or feature on your first day. You have to let the marketplace grow and mature somewhat, to see what will actually be useful. Still, you want to plan ahead. As you watch the marketplace, you will spot opportunities well in advance, so you can position yourself to implement them before the need is urgent.

Focus on your business

Besides making things easier for customers, being a better middleman means improving how your business runs.

To start, identify and eliminate inefficiencies in your operations. I don’t mean that you should cut corners, as that will come back to bite you later. I mean that you can check for genuine money leaks. The easy candidates will be right there on your balance sheet: have you actually used Service ABC in the last year? If not, maybe it’s time to cut it. Is there an equivalent to Service XYZ at a lower price? Once you’ve confirmed that the cheaper service is indeed a suitable replacement, it’s time to make the switch.

A more subtle candidate is your codebase. Custom code is a weird form of debt. It requires steady, ongoing maintenance just like payments in a loan. It may also require disruptive changes if you encounter a bug. (Imagine that your mortgage lender occasionally demanded a surprise lump sum in mid-month.) Can you replace that home-grown system with an off-the-shelf tool or a third-party service, for a cheaper and more predictable payment schedule?

You also want to check on the size of your total addressable market (TAM). What happens when you’ve reached everyone who will ever join? It’s emotionally reassuring to tell yourself that the entire planet will use your service, sure. But do you really want to base revenue projections on customers you can’t realistically acquire or retain? At some point, your customer numbers will plateau (and, after that, sink). You need to have a difficult conversation with yourself, your leadership team, and your investors around how you’ll handle that. And you need to have that conversation well in advance. Once you hit that limit on your TAM, you’ll need to be ready to deliver improvements that reduce churn. Perhaps you can offer new services, which may extend your addressable market into new territory, but even that has its limits.

What are you doing for risk management? A risk represents a possible future entry on your balance sheet, one of indeterminate size. Maybe it’s a code bug that spirals out of control under an edge case. Or a lingering complaint that blossoms into a full-scale PR issue. To be blunt: good risk management will save you money. Possibly lots of money. While it’s tempting to let some potential problems linger, understand that it’s easier and cheaper to address them early and on your own schedule. That’s much nicer than being under pressure to fix a surprise in real-time.

Sharp-eyed readers will catch that subtle tradeoff between “addressing inefficiencies” and “proactively mitigating risks.” Risk management often requires that you leave extra slack in the system, such as higher staff headcount, or extra machines that mostly sit idle. This slack serves as a cushion in the event of a surge in customer activity but it also costs money. There’s no easy answer here. It’s a blend of art and science to spot the difference between slack and waste.

Most of all, as a marketplace, you want to mature with your customers and the field overall. The term “innovate” gets some much-deserved flack, but it’s not complete hogwash. Be prepared to invest in research so you can see what changes are on the horizon, and then adapt accordingly. Also, keep an eye on the new features your customers are asking for, or the complaints they raise about your service. You’ll otherwise fall into the very trap described in The Innovator’s Dilemma. Don’t become the slow-moving, inattentive behemoth that some nimble upstart will work to unseat.

Use technology as a force multiplier

Bad middlemen squeeze the parties they connect; good middlemen squeeze technology.

Done well, technology is a source of asymmetric advantage. Putting code in the right places allows you to accomplish more work, more consistently, with fewer people, and in less time. All of the efficiencies you get through code will leave more money to split between yourself and your customers. That is a solid retention strategy.

To start, you can apply software to real and artificial scarcity that exists in other middlemen. A greenfield operation can start with lower headcount, less (or zero!) office space, and so on.

Tech staffing, for example, is a matching problem at its core. A smart staffing firm would start with self-service search tools so a company could easily find people to match their open roles. No need to interact with a human recruiter. It could also standardize contract language to reduce legal overhead (no one wants a thousand slightly-different contracts laying around, anyway) and use electronic signatures to make it easier to store paperwork for future reference.

You don’t even have to do anything fancy. Sometimes, the very act of putting something online is a huge step up from the incumbent solution. Craigslist, simply by running classified ads on a website, gave people a much-improved experience over the print-newspaper version. People had more space to write (goodbye, obscure acronyms), had search functionality (why skim all the listings to find what you’re after?), and could pull their ad when it had been resolved (no more getting phone calls for an extra week just because the print ad is still visible).

Technology also makes it easier to manage resources. Love or loathe them, rideshare companies like Lyft and Uber can scale to a greater number of drivers and riders than the old-school taxi companies that rely on radio dispatch and flag-pulls. And they can do it with less friction. Why call a company and tell them your pickup location, when an app can use your phone’s GPS? And why should that dispatcher have to radio around in search of a driver? To arrange a ride, you need to match three elements–pickup location, dropoff location, and number of passengers–to an available driver. This is a trivial effort for a computer. Throw in mobile apps for drivers and passengers, and you have a system that can scale very well.

(Some may argue that the rideshare companies get extra scale because their drivers are classified as independent contractors, and because they don’t require expensive taxi medallions. I don’t disagree. I just want to point out that the companies’ technology is also a strong enabler.)

Being at the center of the marketplace means you get to see the entire system at once. You can analyze the data around customer activity, and pass on insights to market participants to make their lives easier. Airbnb, for example, has deep insight into how different properties perform. Their research team determined that listings with high-quality photos tend to earn more revenue. They publicized this information to help hosts and, to sweeten the deal, the company then built a service to connect hosts with professional photographers.

What about ML/AI? While I hardly believe that it’s ready to eat every job, I do see opportunities for AI to make a smaller team of people more effective. ML models are well-suited for decisions that are too fuzzy or cumbersome to be expressed as hard rules in software, but not so nuanced that they require human judgment. Putting AI in the seat for those decisions frees up your team for things that genuinely merit a human’s eyes and expertise.

I’ve argued before that a lot of machine learning is high-powered matching. What is “classification,” if not rating one item’s similarity to an archetype? A marketplace that deals in the long tail of goods can use ML to help with that matching.

Take Reverb, where most pieces of gear are unique but still similar to other items. They’re neither completely fungible, nor completely non-fungible. They’re sort of semi-fungible. To simplify search, then, Director of Analytics Cyril Nigg says that the company groups related items into ML-based canonical products (where some specific Product X is really part of a wider Canonical Product Y). “[We use] ML to match listings to a product–say, matching on title, price point, or some other attribute. This tells us, with a high degree of confidence, that a seller’s used Fender guitar is actually an American Standard Stratocaster. Now that we know the make and model, a buyer can easily compare all the different listings within that product to help them find the best option. This ML system learns over time, so that a seller can upload a listing and the system can file it under the proper canonical product.”

Machine-based matching works for food as well as guitars. Resham Sarkar heads up data science at Slice, which gives local pizzerias the tools, technology and guidance they need to thrive. In a 2021 interview, she told me how her team applies ML to answer the age-old question: will Person X enjoy Pizza Y at Restaurant Z? Slice’s recommendations give eaters the confidence to try a new flavor in a new location, which helps them (maybe they’ll develop a new favorite) and also helps pizzerias (they get new customers). This is especially useful when a pizza lover lands in a new city and doesn’t know where to get their fix.

Any discussion of technology wouldn’t be complete without a nod to emerging tech. Yes, keeping up with the Shiny New Thing of the Moment means having to wade through plenty of hype. But if you look closely, you may also find some real game-changers for your business. This was certainly true of the 1990s internet boom. We’ve seen it in the past decade of what we now call AI, across all of its rebrandings. And yes, I expect that blockchain technologies will prove more useful than the curmudgeons want to let on. (Even NFTs. Or, especially NFTs.)

Skip past the success stories and vendor pitches, though. Do your own homework on what the new technology really is and what it can do. Then, engage an expert to help you fill in the gaps and sort out what is possible with your business. The way a new technology addresses your challenges may not align with whatever is being hyped in the news, but who cares? All that matters is that it drives improvements for your use cases.

Watch your tech

Technology is a double-edged sword. It’s like using leverage in the stock market: employing software or AI exposes you to higher highs when things go right, but also lower lows when things unravel.

One benefit to employing people to perform a task is that they can notice when something is wrong and then stop working. A piece of code, by comparison, has no idea that it is operating out of its depth. The same tools that let you do so much more, with far fewer people, also expose you to a sizable risk: one bug or environmental disconnect can trigger a series of errors, at machine speeds, cascading into a massive failure.

All it takes is for a few smaller problems to collide. Consider the case of Knight Capital. This experienced, heavyweight market-maker once managed $21BN in daily transaction volume on the NYSE. One day in 2012, an inconsistent software deployment met a branch of old code, which in turn collided with a new order type on the exchange. This led to a meltdown in which Knight Capital lost $440M in under an hour.

The lesson here is that some of the money you save from reduced headcount should be reinvested in the company in the form of people and tools to keep an eye on the larger system. You’ll want to separate responsibilities in order to provide checks and balances, such as assigning someone who is not a developer to manage and review code deployments. Install monitors that provide fine-grained information about the state of your systems. Borrowing a line from a colleague: you can almost never have too many dimensions of data when troubleshooting.

You’ll also need people to step in when someone gets caught in your web of automation. Have you ever called a company’s customer service line, only to wind up in a phone-tree dead-end? That can be very frustrating. You don’t want that for your customers, so you need to build escape hatches that route them to a person. That holds for your AI-driven chatbot as much as your self-help customer service workflows. And especially for any place where people can report a bug or an emergency situation.

Most of all, this level of automation requires a high-caliber team. Don’t skimp on hiring. Pay a premium for very experienced people to build and manage your technology. If you can, hire someone who has built trading systems on Wall St. That culture is wired to identify and handle risk in complex, automated systems where there is a lot of real money at stake. And they have seen technology fail in ways that you cannot imagine.

Markets, everywhere

I’ve often said that problems in technology are rarely tech-related; they’re people-related. The same holds for building a marketplace, where the big problem is really human greed.

Don’t fall for the greed trap. You can certainly run the business in a way that brings you revenue, keeps customers happy, and attracts new prospects. Identify inefficiencies in your business operations, and keep thinking of ways to make the platform better for your customers. That’s it. A proper application of software and AI, risk management, and research into emerging technologies should help you with both. And the money you save, you can split with your user base.

If you’re willing to blur the lines a little, you will probably find markets in not-so-obvious places. An airline sits between passengers and destinations. Grocery stores sit between shoppers and suppliers. Employers sit between employees and clients. And so on. Once you find the right angle, you can borrow ideas from the established, well-run middlemen to improve your business.

(Many thanks to Chris Butler for his thoughtful and insightful feedback on early drafts of this article.)