Serving workers in the gig economy

Emerging resources for the on-demand workforce.

Bees

Bees

The Great Unbundling

We are in the midst of a great social and economic shift. Global, mobile connectivity and ubiquitous data are steadily restructuring not only our interpersonal relationships, but our economic and industrial systems. This great reshaping has often been referred to as unbundling—the breaking up of previously understood packages of goods and services into their component parts, eventually to be rebundled in new ways.

We are familiar with the unbundling of the media and publishing industries—from triple-play cable packages to Internet + Netflix + Amazon + AppleTV; from compact discs to MP3 downloads, to streaming services; from print newspapers and books to blogs and eBooks—and the same is steadily happening to every other economic and industrial sector.

It’s even happening in highly regulated sectors such as transportation (ride-sharing), housing (home sharing), finance (peer-to-peer lending, crowdfunding, Bitcoin), and health (telemedicine, personal sensors, home diagnostics), where the regulations that shaped these sectors in the 20th century are coming under intense pressure to adapt.

This great unbundling means that products and services are often much more accessible, in much smaller pieces, and from a greater number of providers.

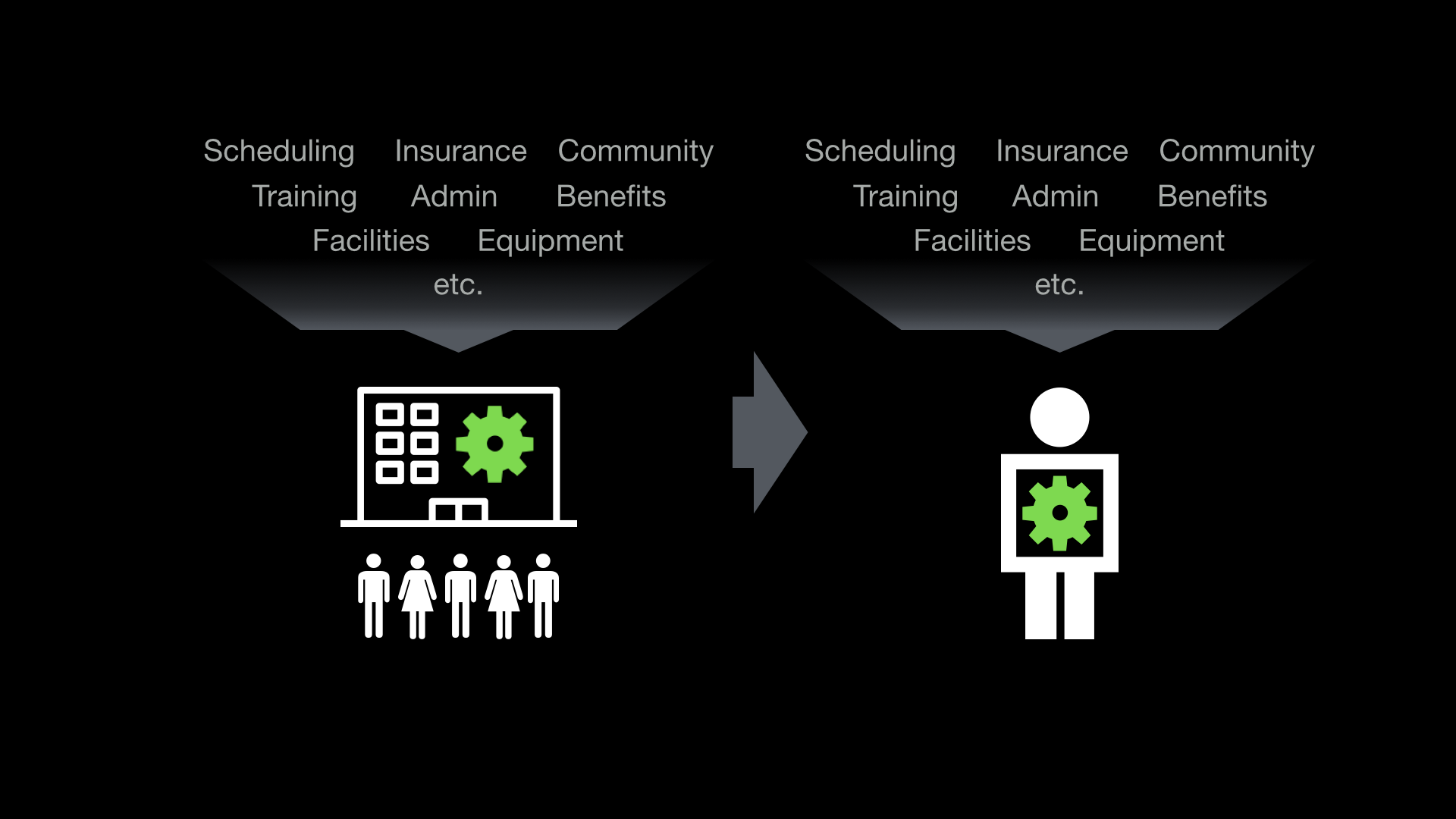

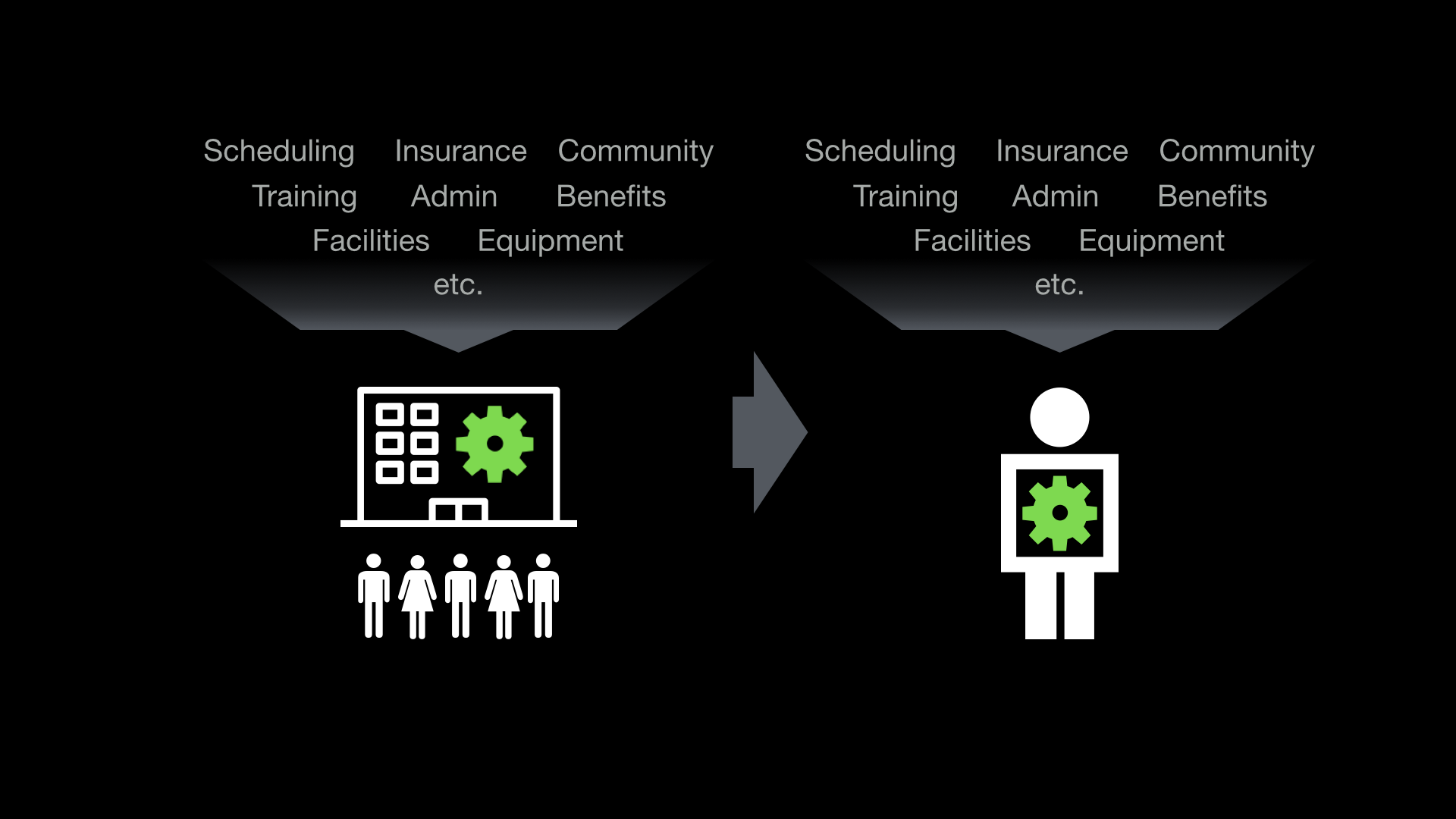

What is true from the consumer’s perspective is also true from the worker’s perspective: work is now more accessible than ever, but it’s coming in a different form. Rather than a single job from a single employer, we now have access to many jobs from many sources, in many shapes and sizes. As this happens, the very notion of a “job” is being unbundled into its component parts.

The Unbundling of the Job

So, what’s in a job, exactly? What are its component parts? How are they coming unbundled?

Author Nick Grossman’s colleague from Union Square Ventures, Albert Wenger, describes it as such:

“Do people need jobs or can we deliver what jobs provide some other way and in a potentially unbundled fashion? The “jobs of a job” include income, structure, social connections, meaning, and at least in the US, access to healthcare.”

In other words, the things we’ve come to think of as the components of a “job” aren’t inherently bound together. And indeed, the unbundling of the job means that each of these components, and more, are becoming available from new places, and are able to be bound together in new ways.

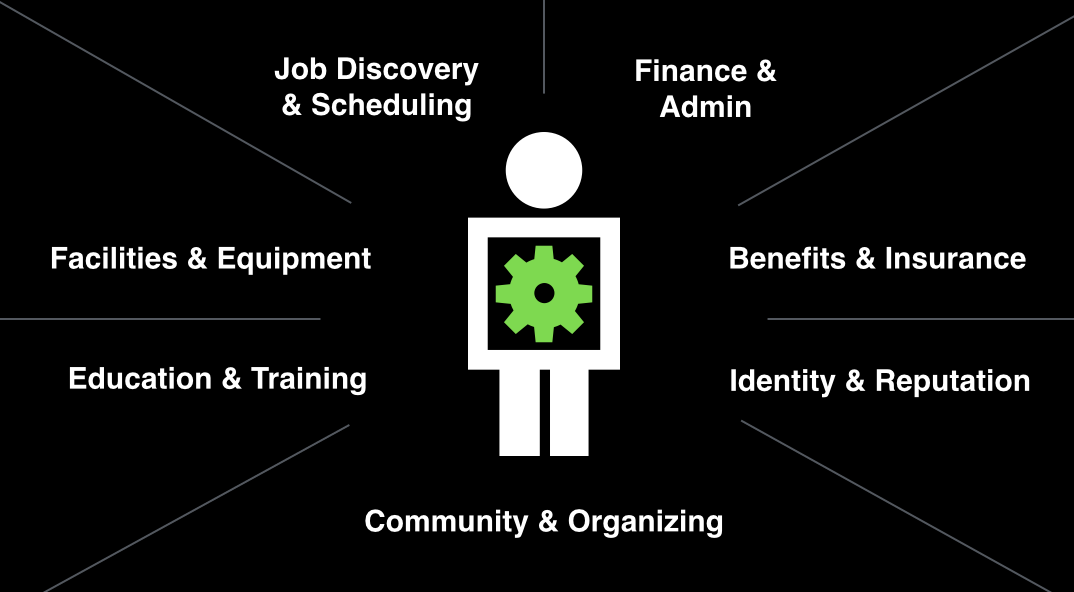

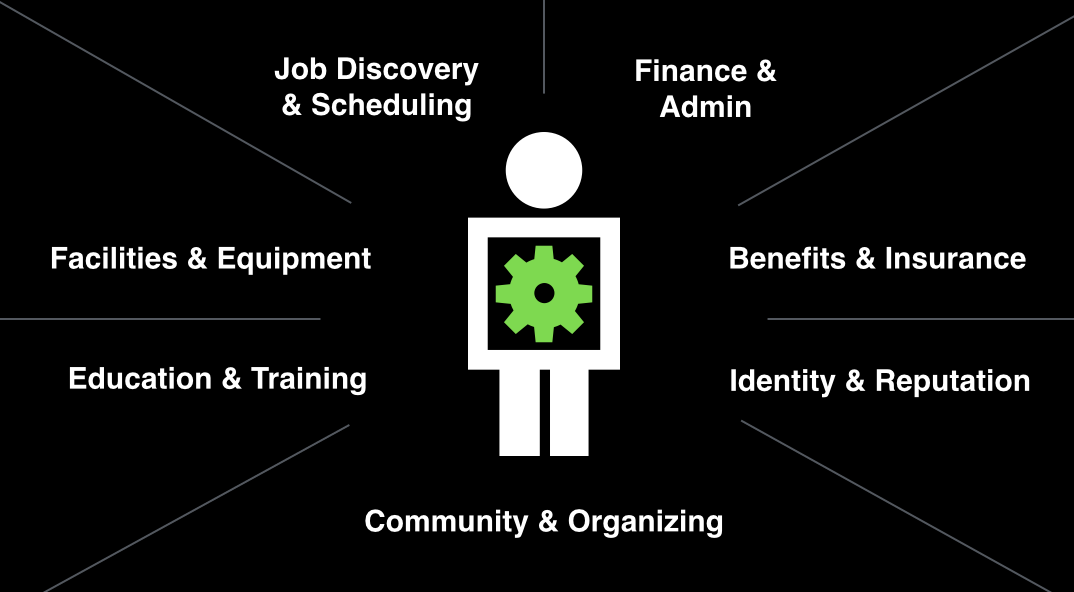

Later in the report, we’ll look in detail at the following components of the work bundle:

- Job Discovery and Scheduling

- How one finds work and manages his/her time

- Finance and Administration

- Managing money and admin tasks such as paying taxes

- Benefits and Insurance

- From healthcare, to worker’s comp, to retirement

- Identity and Reputation

- Both are critical to succeeding in the gig economy

- Community and Organizing

- Modern versions of the water cooler and union hall

- Education and Training

- Skills development, just as with work, comes from many sources

- Facilities and Equipment

- Rethinking what it means to be “in the office”

Much attention has been paid to the first component, which is essentially income. Independent from the other previously bundled components of “a job,” it’s easier than ever to find sources of income online. A major force here is the “platformization” of work, meaning the emergence of web and mobile job marketplaces and work platforms such as Amazon’s Mechanical Turk, the freelancer marketplace Upwork, and on-demand service platforms such as Uber, Handy, and Doctor on Demand.

Online work platforms build on top of these fundamental trends and provide two primary services: first, making markets, cultivating and sustaining both supply and demand; and second, establishing “trust and safety” systems (such as escrow, reputation, insurance, and acceptable use policies) that ensure the smooth operation of the marketplace.

Such platforms are not the underlying cause of the shift, but are rather an accelerant. There are more fundamental drivers of this shift:

- The web and mobile connectivity that enables more direct, person-to-person transactions of all types.

- The age-old push of corporations to lessen their reliance on full-time workers, and increase the utilization of part-time and contract workers, for cost-saving reasons.

All told, these forces are drawing more and more people into the part-time labor force, aka the “gig economy.” According to a recent study by Freelancers Union and Upwork, in 2015, nearly 54 million Americans—roughly 34% of the US population—participated in some form of freelance work, and the trend is accelerating year over year.

Aside from the income component of the job bundle, which has seen enormous experimentation and growth in the past decade, we are now beginning to see the emergence of the other parts of the bundle. That’s what this report will focus on—the tools and services that gig workers might begin to rely on to fulfill the set of needs that was previously fulfilled by a full-time job.

We should note that the “gig economy” is not monolithic. It includes work that is both low wage/commodity (such as driving and traditional hourly shift work), as well as high-end and specialized (such as graphic design and medical services). It includes work that looks more like “a job” (such as delivering food) and work that looks more like a “micro-business” (such as producing and selling craft goods).

“The things that stress out Gig Economy individuals are largely the same stresses suffered by someone who works at Target or in a pretty traditional service employment capacity.”

Quinten Farmer, Even

At the same time, many of the same considerations apply throughout the “gig economy,” the most fundamental being a less stable source of reliable income, and less access to traditional benefits and protections.

The Gig Worker’s Dilemma

“As an independent worker, all this infrastructure and stuff used to be taken care of by a company and now you have to figure it out on your own. And it can be impossible to solve.”

Shelby Clark, Peers

The heart of the challenge of being a gig worker is that you’re on your own. No single employer is responsible for you or to you. You’re no one’s responsibility, except your own. This means that it’s up to you not only to find work and stay busy, but also to manage all of the overhead that comes with being a worker, “business owner,” and taxpayer. If we imagine all of the support services that were previously bundled with full-time employment—from steady employment and income, to navigating the federal and state bureaucracies, to providing benefits and insurance—all of that now falls on the worker directly.

Looking at the job bundle outlined above, the job-related components of the social safety net are of critical importance. Traditionally, much of that safety net—in particular, benefits such as unemployment, disability, retirement, and worker’s comp—have come from employers, based on the assumption that people will have a single employer with whom they have a long-term, monogamous relationship.

But as work becomes unbundled, the underlying assumption that the social safety net can stay bundled to the job is being challenged.

For reference, below is a brief review of the primary benefits and protections that have traditionally been bundled with employment:

| Steady income | The foundational need to have steady, reliable income, to support basic needs. Traditionally, firms have shouldered this risk and hired accordingly. |

| Minimum wage | Price floor for wage labor, intended to ensure a minimum standard of living. |

| Overtime pay | Employees are typically entitled to 1.5 times pay for work exceeding 40 hours per week.1 |

| Antidiscrimination | The Civil Rights Act and the Americans with Disabilities Act prohibit hiring discrimination on the basis of race, color, sex, ethnic origin, and disability, respectively.2 |

| Workplace health and safety | The Occupational Health and Safety Administration (OSHA), a part of the US Department of Labor, specifies workplace safety standards and regulations.3 |

| Healthcare | Medical, vision, dental. Employers are required to offer affordable (<= 9.5% of take-home pay) health plans to employees working 30 hours per week or more.4 |

| Workers’ compensation | Wage replacement and medical coverage for on-the-job injuries; typically offered in exchange for releasing employer from liability.5 |

| Unemployment | Wage replacement during times of unemployment. Typically paid for by employer. Independent contractors must pay into their home state’s unemployment fund.6 |

| Disability insurance | Paid sick leave, short-term and long-term disability payments. Typically paid by employer. Independent contractors may purchase their own insurance.7 |

| Professional liability insurance | Protects companies and independent contractors from liability claims arising from services performed. Also known as errors and omissions (E&O) insurance. |

| Retirement savings | Savings plans featuring tax-advantaged contributions and often featuring employer contributions. |

| Payroll taxes | Bundle of employer contributions and employee withholdings, contributing to Social Security, Medicare, unemployment, and other programs; handled by employer at payroll time.8 |

| Training | Employers often provide employees with training programs, but are limited in doing so for independent contractors. |

| The right to organize | Workers have the legal right to organize for negotiating leverage with employers. Independent contractors may not do so out of antitrust concerns. |

| Various other protections at the state level | Labor laws vary greatly on a state-by-state basis. |

Because these protections have been traditionally bundled with work and are typically handled seamlessly within a firm, they have become almost invisible and taken for granted, so many workers may not even know what they’re missing when they switch away from traditional employment status.

As more workers shift from traditional employees to gig workers, the responsibility of reassembling these protections falls to them. In other words, a gig worker is like a tiny, one-person company, responsible for creating his or her own personal HR department.

This constitutes both a massive shift in risk, a steep learning curve on the part of gig workers, and a fundamental restructuring of the worker support ecosystem. While this initially exposes gig workers to significant risk, it also opens up the market for a new generation of worker support services, which is what this report will explore.

Worker Classification: W2 Employee vs 1099 Contractor

Central to the public debate around the gig economy has been the issue of worker classification.

All labor laws, at the federal and state level, are built around the idea of a core distinction between employee and independent contractor, where employees (W2 status) receive all of the benefits outlined in the previous section, and independent contractors (1099 status) receive none.

This distinction made sense in a world where you were either a full-time, dedicated employee (factory worker or executive), or a real standalone personal business (plumber or doctor), but becomes problematic as the gig economy grows.

At the heart of this distinction is the notion of control: how much control does the labor buyer (employer, client) have over the labor supplier (employee, contractor)? The more that control is exercised—in the form of scheduling, behavior specification and training, rate setting, etc.—the more the law views that as an employer/employee relationship. The less control that is exercised, the more the law views the relationship as between an independent contractor and their client.

The IRS breaks down the question of control into three sections:

| Behavioral Control covers facts that show if the business has a right to direct and control what work is accomplished and how the work is done, through instructions, training or other means. |

Financial Control covers facts that show if the business has a right to direct or control the financial and business aspects of the worker’s job. This includes:

|

Relationship of the Parties covers facts that show the type of relationship the parties had. This includes:

|

| IRS Topic 762 – Independent Contractor versus Employee |

As we consider these distinctions in the context of the unbundling of the job, they become much more fuzzy and much less effective at protecting workers.

“A good example of a 1099 job would be, build a fence for my company. This guy comes, I don’t tell him when to show up, he works until he’s done and then he leaves. It takes him as long as it’s going to take. I don’t have any type of management on how the work is performed. I only have an agreement on what the outcome should be. Then, on the other end of the spectrum, you have management, you tell them to show up from 8 am to 5 pm and these are the tasks you have to do and this is your supervisor. That’s a W2 employee.

There’s no space for, what if I only work three days a week? Most of our workers work like that.”

Michele Casertano, BlueCrew

Today’s regime of labor protections dates back to the Fair Labor Standards Act of 1938, part of the New Deal. Ever since then, there have been disputes about employee classification and the applicability of labor standards. So while this is not a new issue, the rapid growth of the “platformized” gig economy has accelerated the challenges embedded in this system, and brought them further into the public eye.

There are currently several cases playing out that are testing the applicability of our existing labor laws to the digitally powered gig economy. For example, the home cleaning platform Homejoy recently shuttered its doors under pressure from a number of employee classification lawsuits. A similar service, Handy, which also uses a network of 1099 contractors, is currently subject to a class-action lawsuit contesting worker classification. And the popular ride-sharing services Uber and Lyft are both defendants in class action suits challenging worker classification.

Largely in response to these legal developments, some gig economy platforms have begun shifting workers over to W2 status. High-profile examples include the virtual assistant service Zirtual (which recently went out of business, shortly after switching to a W2 model), the shipping service Shyp, and the office management service Managed by Q.

No matter which way the courts decide today’s and tomorrow’s cases, it is clear that the unbundling of work has created a conundrum that’s testing our current labor law regime.

“It’s clear that the system that was set up to provide stability for workers in the 1935 industrial economy is not the one we need at the moment right now. This is like a broken system…. I think the whole system needs a rewire. And the rapid growth of the gig economy and the incredible media attention and glamour of this new thing is just sort of concentrating that situation that was frankly broken anyway.”

Michelle Miller, Coworker.org

Meanwhile, as the courts wrestle with the facts and circumstances of these worker classification lawsuits, a new ecosystem of services is rapidly emerging to support workers in the gig economy.

Support Services for Gig Workers: Today’s Emerging Ecosystem

“The future of the labor movement has to be more than one thing and workers need space to invent it.”

Michelle Miller, Coworker.org

For this report, we interviewed 12 startups (see Company Profiles) that are approaching aspects of the worker support ecosystem, to try and understand how they see the landscape evolving, which services they believe will be the most important and effective, and what kinds of go-to-market strategies they are exploring.

As of the writing of this report, nearly all of these services are in their infancy and are in a state of flux, as they respond to the rapid growth and rate of change in and around the gig economy.

A common theme across these emerging tools and services is that they recognize that the worker is at the center—whether in a traditional employment relationship, or in a contractor relationship. Many of the companies and organizations we spoke to describe themselves as “advocates” or “agents” for the workers, clearly siding with the worker in cases where there could be a conflict or misalignment of interests.

Another common theme is a desire to retain the flexibility and freedom of gig work, while obtaining the protections and benefits of traditional full-time work:

“That’s what we hear from our customers all the time, that they like their flexible lifestyle. Let’s not remove that, but let’s raise the bar in terms of accessibility and affordability, frankly, for protection.”

Noah Lang, Stride Health

As we explore the emerging services being offered to gig workers, the primary question this report intends to address is: can independent workers have their cake and eat it too? Can the market respond to the shift in the labor landscape to offer new, innovative tools that re-assemble the social safety net?

Below, we break down the ecosystem of emerging worker support services into several primary functions (what we called “components of the work bundle” at the beginning of this report), and look at what need is addressed, and examine the various approaches being pursued.

Job Discovery and Scheduling

As jobs get broken into much smaller pieces coming from a much larger group of sources, the result is a fragmented landscape that can be difficult and overwhelming to take in from the worker’s perspective. And of course, finding work is step one toward getting paid, so job discovery is perhaps the most critical function in the emerging gig work market.

Of course, each consumer platform (Handy, Lyft, Postmates, etc.) also serves as its own job-discovery system, but we are now beginning to see the emergence of job-discovery platforms that span multiple work providers, and take a more active role in managing gig workers’ time and optimizing for their experience and earnings.

For example, Dispatcher acts as a “common application” for on-demand platform jobs. In doing so, Dispatcher signs up on the worker’s behalf and mediates the relationship between the worker and the work platform, serving as a virtual “agent” for the worker, and over time, building a dataset about earnings across the on-demand economy that can inform the decisions workers make about where to work and when.

“Our vision in the future is to potentially predict what are the best jobs based on location and time. So workers can pick and choose, essentially. If Uber’s paying me $20/hour while Postmates, because it’s dinner [time], is paying me $30/hour, a worker may decide to do Postmates rather than Uber. Today, they don’t have that visibility. The thinking is that, with Dispatcher, when we become the labor exchange, that visibility will get exposed.”

Robert Yau, Dispatcher

Note that Dispatcher, and similar services such as Opus for Work (not interviewed for this report) are essentially betting that the 1099 independent contractor model will prevail, and are looking to optimize for that environment.

Others, such as BlueCrew and WorkGenius (not profiled for this report) are taking a different approach. These platforms, rather than simply brokering workers to independent contractor opportunities, take a step further and act as full-time employers, offering the full suite of traditional benefits and protections to their employees. Then, they surface on-demand jobs for their employees to claim as they see fit.

BlueCrew and WorkGenius are seeking to solve a problem for both the job platform and the worker: workers receive the traditional benefits and protections that come with traditional employment, and job platforms (regardless of whether they use a W2 or 1099 model) relieved of the HR burden associated with these workers.

These platforms also look to play a role by performing employer-related activities that on-demand platforms wish they could, such as providing in-depth training and imposing demanding standards regarding work performance and on-time arrival. Work platforms such as Postmates and Handy currently can’t engage in those tasks for fear of employee misclassification lawsuits.

The founders of both Dispatcher and WorkGenius describe their role as akin to “supply side platforms” in the online advertising business, which represent publishers (ad inventory sellers) in automated ad exchanges, optimizing for their income. To the extent that certain forms of on-demand work are relatively commoditized, and work can take place equally well across many work platforms, this analogy could hold true.

“We see ourselves, like I said, analogous to the ad system with a real-time exchange where you have supply-side platforms and demand-side platforms. We want to be the exchange and the supply-side platform. Because the demand-side platforms are like Uber already. They’re very good at aggregating demand and optimizing experiences for customers who are ordering rides or food. Very few companies are optimizing the yield—meaning, pay or earnings—for the supply side.”

Teck Chia, Dispatcher

A critical part of the vision of being a “supply-side platform” is bringing price transparency to the marketplace. For on-demand labor to be a functioning market, akin to stocks, commodities, or online advertising, real price (wage) discovery across work platforms will be critical, and worker-side platforms that see data from a large number of work platforms will be able to discern the true market value for a given worker’s labor at a given time and place.

Adjacent to job discovery is the issue of scheduling. Scheduling has been a particular challenge for hourly W2 employees, who are often scheduled by algorithms that optimize for employers’ benefit, at the same time wreaking havoc on the lives of workers and their families. Note: this is one area where W2 employees are at a distinct disadvantage relative to 1099 contract workers, as employers can exercise extensive control over workers’ time, often making it difficult or impossible for them to work multiple part-time jobs simultaneously.

One company attacking this problem directly is Shift Messenger, which creates a tailored chat room for hourly workers (for example, at Starbucks or Home Depot), where it’s easy to post shifts you need covered and swap with your co-workers. (Competitors to Shift Messenger include Crew and Coffee Mobile, neither of which was interviewed for this report.)

“The biggest piece of feedback is that it makes it much easier for them to manage their work lives. It was really, really hard if the schedule just came out and you had to be there and there wasn’t that much flexibility in whether or not you were going to make it. And from the manager’s perspective, some of the biggest feedback is that it saves them a huge amount of time.”

Austin Vedder, Shift Messenger

In both gig economy job discovery and scheduling in traditional hourly work, these platforms are looking to shift power and control to the workers’ hands, giving them the ability to optimize their most valuable asset, their working time.

Finance and Administration

Workers’ professional and financial lives are inextricably intertwined, and as work becomes fragmented and unbundled, an individual’s financial and administrative picture becomes more complicated, not less. As such, we are seeing a tremendous amount of activity focused on assisting gig workers with their finances and administrative tasks.

Challenges here are compounded by broader socio-economic forces that make it expensive to be poor, as, generally speaking, the financial services ecosystem is ill-suited to the needs of low-income workers.

One company addressing this challenge directly is Even, a banking product that helps hourly workers manage the ups and downs of an unpredictable work schedule and income stream. Even learns your earning pattern, and helps turn lumpy hourly or gig-work income into steady, predictable income. After busy weeks, Even sweeps some of your earnings into a savings account, and after slow weeks, Even either passes you money from savings, or offers you a small interest-free loan that’s based on your historical and expected earnings. (Even takes a flat, $3/week fee for its services.)

Quinten Farmer, Even’s co-founder notes that the pre-existing financial options for low-income hourly workers are quite bad:

“It’s a fairly equal split between payday loans and overdrafts. Depending on the customer and where they bank, they’re basically the same thing. If you overdraft your account, even by a small amount, you get hit with a huge fee: $35, $35 a day or more in some cases. You’re basically paying to have access to those extra funds. We certainly see people getting online payday loans, too. And that typically happens after you get a low paycheck. Before someone used Even, a low paycheck meant that you had to get funds somewhere else. And typically those sources of funds are not very consumer friendly.”

Quinten Farmer, Even

We can certainly expect more banking-related products to emerge as the gig economy continues to grow.

Other emerging services focus on administrative functions related to finances and taxes. Hurdlr, SherpaShare (profiled below) as well as And Co and Benny and the recently defunct Zen99 provide a variety of helpful administrative services, largely focused on tracking income and expenses, to both understand one’s true income and also to prepare for paying taxes.

SherpaShare is specifically focused on the driver market, making it easy to track mileage (and calculate applicable expenses and deductions) and analyze earnings across multiple platforms (currently integrated with Lyft, Uber, Sidecar, DoorDash, and Postmates).

“Our take on this tax piece is, you can pay $100 to a CPA to file your taxes for you. The challenging part is the tracking part because you need to do it everyday and most people are not capable of doing that. So, that’s the area where SherpaShare wants to help.”

Jianming Zhou, SherpaShare

Hurdlr is more general purpose, but also includes tailored experiences for Uber and Postmates drivers, as well as Airbnb hosts. AndCo, Benny, and Zen99 are much more broadly targeted at independent workers and freelancers.

All of these platforms aim to ease the considerable administrative burden that comes with being a gig worker, in particular calculating net earnings, setting aside funds for various forms of insurance, and preparing and paying for taxes.

“From April 2015, we found the majority of the drivers didn’t know they had tax obligations until they received a 1099. That was a much bigger thing in 2015 than in 2014 because of that growth in Uber drivers. So, there was this general awareness growing. A lot of folks found out what their true income really was [in 2015]. [A job] might be marketed as $20/hour, but it might be closer to $9-12 after expenses and taxes.”

Raj Bhaskar, Hurdlr

It is particularly interesting to see each of these administrative and banking tools experiment with approaches that make them dead-simple to use—because, for example, even the most elegant tool for tracking expenses won’t work for most people if they have to go through the effort of entering expenses and categorizing them. For example, in addition to the approaches discussed above, AndCo wraps their whole experience in a chat window with your virtual “chief operator,” attempting to make the experience simple and human.

Simplicity and ease of use become even more important when wading into the complicated and confusing world of benefits, healthcare, and insurance.

Benefits, Healthcare, and Insurance

After finding work, getting paid, and managing finances, comes the unsexy but critically important task of acquiring healthcare and other forms of insurance. This is the area particularly in question with all of the worker-classification lawsuits discussed above and is where exists the most major disconnect between labor laws and the structure of the gig economy.

“There’s no such thing as workers’ comp for independent workers. Short-term disability is very difficult to find as an independent worker. So we’re working with insurance carriers on those products. And I think the most interesting part of it would be this concept of pro-rated payments. So, as opposed to having these very binary solutions of employees with all the benefits and independent workers with none, there’s sort of this middle ground where companies would make contributions across the benefits on a pro rata basis.”

Shelby Clark, Peers

Companies in this space are taking a wide variety of approaches to providing the traditional slate of benefits and insurance to gig workers:

As mentioned above, employment platforms for on-demand workers such as BlueCrew and WorkGenius are offering traditional W2 employment to gig workers, under which they provide worker benefits and protections.

Other organizations are experimenting with new kinds of insurance products. For example, Peers is working on a program of benefits that are (1) portable, staying with the worker regardless of employer, (2) newly structured to allow for, for example, workers’ compensation insurance for work across multiple employers, and (3) a payments system that allows for multiple employers to fund an individual’s benefits.

Stride Health, another startup in the space, is looking to wrap the entire experience of managing healthcare in a worker-oriented and user-friendly package:

“We take the full value to the end individual and say, ‘We are your advocate, we are going to wrap this entire experience of dealing with insurance companies, of dealing with the government, of dealing with your practitioner—who is your doctor—and wrap that whole experience so you have someone who’s on your side.”

Noah Lang, Stride Health

For Stride, what started as a simple brokerage model has evolved into a more comprehensive and sustained engagement model. They have recently partnered with large work platforms such as Uber, TaskRabbit, and Postmates so that workers can both obtain coverage and access healthcare services from directly within the work app.

One of the oldest organizations serving independent workers is the Freelancers Union. For over 20 years, Freelancer’s Union (and its original parent organization, Working Today) has provided a variety of support services for independent workers, including advocacy, education, community, and several insurance products. Freelancers Union’s latest insurance product, Freelancers Medical, pairs a traditional healthcare plan (provided through a partnership with Empire Blue Cross/Blue Shield) with specialized primary care centers where members can access a broad array of urgent care, preventative health, and wellness services.

Freelancers Union’s Executive Director, Sara Horowitz, is skeptical that market actors alone will address the profound needs for worker benefits, and instead urges policymakers to help cultivate a market for social sector actors like the (non profit) Freelancers Union:

“I think a portable benefits system that’s just about a platform that’s Silicon Valley and [that] individuals buy from, is not what I would support. It will be a disaster and it will only be for affluent and healthy people. But what we need to do is be as creative as both Roosevelts: Teddy and Franklin. And to envision a way that we create a whole new class of benefit groups that are social sector actors. And they can group together around their community and be able to then help deliver the safety net.”

Sara Horowitz, Freelancers Union

One idea is constant across all of the actors addressing the benefits and insurance space: data will play an increasingly major role in supporting the assignment and delivery of worker benefits in the gig economy.

Identity and Reputation

If every individual person in the gig economy is a miniature company, then identity and personal reputation are his/her professional brand and calling card. Further, because so much of the gig economy is mediated through digital platforms, a very granular data stream of work history and performance is being created, which can be used for many things, including job discovery, benefits, banking, and more. As such, controlling, or at the very least, having access to, this data will be central to workers’ control over their professional lives.

For example, reputation gained on one platform could be used to bootstrap an income stream on another platform, assuming the work is transferrable (especially relevant in commodity service areas such as driving). Such data portability would not only give workers more flexibility in choosing where and how to work, it would also apply competitive pressure to work platforms, who could no longer count on data “lock-in” to bind workers to their service.

At the moment, most data generated during work in the on-demand economy is treated by default as property of the platform rather than property of the worker, but many worker-oriented startups are exploring ways to draw data into the hands of workers.

Since identity and reputation data are so broadly useful, worker-oriented platforms are approaching the issue of identity and reputation data from a number of very different directions, some very head-on and straightforward, and some less directly.

Taking a head-on approach are reputation platforms Karma and Traity. Both platforms give users the opportunity to link their various online accounts to generate a reputation score (for instance, as a good host on Airbnb or RelayRides).

“The biggest problem we saw was that all these platforms were building their own siloed reputation systems. I built up my profile on eBay over years. I bought and sold hundreds of things; I’ve got a bunch of reviews. If I start selling on Etsy, that [reputation] should be able to port over, but instead I have to start from scratch. Previously, there was no way for me to port that data over. That’s the unique problem that we’re trying to solve with Karma.”

Zach Schiff-Abrams, Karma

At the moment, each mature platform sees significant value in keeping their users’ reputation data within their own system, so driving adoption of a shared reputation system will undoubtedly be a challenge. Conversely, new work/sharing platforms would benefit from users bringing their own reputation data with them, and could help drive the adoption of such shared reputation systems.

Others in this space are looking for alignment between work platforms and individual workers, where data sharing may be possible in the nearer term. For example, identity verification service Opus.me (not profiled for this report) performs background checks and professional credential checks at the behest of work platforms, but then builds a profile that the worker manages and provisions access to. (Note: other background checking services, such as Checkr, were not included in this study as they primarily market their services to work platforms, not workers themselves.)

Others are taking an even less direct path. For example, work discovery platforms such as Dispatcher, BlueCrew, and WorkGenius, and financial tools such as Even, SherpaShare, and Hurdlr all use identity and reputation data in the process of providing their respective primary services, and, if they achieve scale, could leverage that data on behalf of workers in the marketplace.

“If I’m running an on-demand company and I’m hiring some workers, I should be able to onboard, say, someone who’s done 100 rides with Uber and has a 4.8 rating. I should be able to trust that this person has some kind of skills or knowledge to pick something up from Point A and drop it off at Point B, without having to do a lot of orientation and training. So I think identity and reputation is really important in matching workers to work.”

Teck Chia, Dispatcher

As discussed previously in the Job Discovery section, accessible data not only about prevailing wages and rates, but also about worker identity and reputation, will be critical for cultivating the most efficient and competitive labor market. As things stand today, work platforms wield a data asymmetry that affords them significant power over the gig workforce.

Community and Organizing

Decentralized, fragmented gig work has a profound effect on how worker communities are formed and organized. Whereas before we had the water cooler and the union hall, we now have Facebook groups, mobile chat rooms, and online petition campaigns.

An open—and central—question is whether gig workers will be able to build community and organize despite the fact that they rarely share the same physical location.

If the emergence of social networking and social media over the past decade has taught us anything, it’s that web + mobile technologies have the potential to form strong community bonds across large, decentralized communities. The shape of those relationships may look different than what we knew before, but they are powerful in their own ways. We should expect the same with worker community building and organizing.

In both the case of shift workers and on-demand workers, new community infrastructure is being built out where there was none before, or where previous communication tools were especially primitive.

Responding to the question “how can we make tomorrow’s workers more empowered than today’s workers?”, Shift Messenger co-founder Austin Vedder replied:

“I’m biased because this is what we focus on, but I think it’s communication tools that allow them to help one another. If you’re a server at a restaurant, you don’t actually have to be at work to help your coworkers. I think that’s a piece of it that we’re focused on. Maybe they need help with something, they have a question about a promotion that’s running tomorrow, they have an issue with a customer. Or if they need a shift covered. One thing that every hourly worker faces is the shift stuff. But then there’s a very long tail of things that also had to happen in the store or via another ad hoc communication channel before.”

Austin Vedder, Shift Messenger

Austin’s vision of community among shift workers is a network of workers—at the store or perhaps not—who can answer one another’s questions, help each other out, and deepen their overall sense of community.

SherpaShare has also found initial success building a mobile chat community of on-demand drivers:

“The chat feature is a hit…. The fundamental reason is, drivers are alone and they have a need to talk to their fellow drivers…. They also have a social need to talk about their career, how they can make more money, what other workers are doing and Uber and Lyft regulations.”

Jianming Zhou, SherpaShare

Looking up the ladder of engagement begs the question: can gig workers effectively organize in the absence of traditional unions?

Coworker.org, a community and organizing platform targeted at coworkers within large corporations (everything from flight attendants to baristas to on-demand drivers) is taking a gradual approach to community building and organizing. Regarding how they refer, internally, to members of their community, Coworker cofounder Michelle Miller says:

“We call them subscribers, actually. We think of membership as a thing you are very intentional about; “I’m going to join this.” What we’re doing right now is workers’ campaigns led by other workers. And our job over the next 2–5 years is to really nurture networks that form around individual issues or workplaces into something that is a little bit deeper, that sees itself as a functioning network. We’re not there yet, so we call them subscribers.”

Michelle Miller, Coworker.org

Coworker members can self-organize into online petition campaigns:

“We provide tools for people to engage in self-organizing around things they care about. Each of those campaigns does what we think of as two different things: (1) it helps people who have never organized or advocated for themselves at work before to get the experience of, this is what it looks like. So, experiential learning, basically. And then (2) it results in this network of people they’ve recruited to their cause that we then are working with to start to form what we think can be future forms of worker power in companies that are decentralized, disconnected networks of employees.”

Michelle Miller, Coworker.org

Thus far, Coworker-led campaigns have lobbied successfully for policy changes at American Airlines and Starbucks, among others, and have active campaigns on issues such as scheduling, dress code, sick leave, and more.

Meanwhile, Freelancers Union has developed the closest thing to a traditional union for independent workers. Beginning in the mid 1990s, with a focus on independent creative workers (writers, designers, etc.), Freelancers Union has developed a full slate of community and organizing activities, including a policy and lobbying agenda, PR campaigns, and a broad range of educational content aimed at helping independent workers operate more effectively and sustainably.

Education and Training

Education and training is a cross-cutting function present in many of the platforms serving gig workers.

As discussed above in the Finance and Administration section, just the simple switch from being a W2 employee, where taxes are paid up front, to a 1099 contractor, where you do that on your own, is a major shift requiring significant education:

“I personally believe there’s an educational component missing in this space. It needs to go all the way back to high school, I think. The numbers are clear that 1/3 of the workforce will have some form of freelance job or income whether they’re dedicated to that or whether it’s in addition to W2 income. So there has to be some basic education about [finances, taxes, 1099s, Schedule C’s]. I’d argue, for many folks, it’s more valuable than learning Calculus. Not to discount the value of Calculus.”

Raj Bhaskar, Hurdlr

A particular challenge in the education and training space is that work platforms operating on a 1099 model must avoid providing detailed training and work guidance, lest they expose themselves to worker misclassification litigation. This presents an opportunity for worker support platforms to offer training in ways that work platforms cannot.

For example, WorkGenius, a W2 employer that matches their employees with jobs on on-demand platforms, puts a particular focus on the rigor of its training programs, which intend to produce the highest quality workers available in the on-demand economy.

“WorkGenius is an employee-first company. We help you transform on-demand jobs into careers by finding and developing the best gigs. We don’t care where you have worked or where you went to school. If you commit to the WorkGenius code, we will commit to you.

The WorkGenius code:

- We always show up

- We do what we say we’re going to do

- We always work to be the best version of ourselves”

As simple as this code sounds, offering this kind of particular behavioral guidance represents a dangerous line for work platforms operating on a 1099 model (remember: control is at the center of the employee/independent contractor classification), and so is therefore part of the education and training ecosystem that can be filled in by third-party services.

Other products and services have education built-in as a core feature: for example all of the finance and administration platforms have a strong education component, and invest in developing educational materials for their communities, and the Freelancers Union has a long history of educating their community as a core service.

Finally, community platforms such as Shift Messenger and Coworker have the inherent capability to serve as peer-to-peer learning environments. Even Breeze, a service that provides short-term auto leases for on-demand drivers, sees itself as a peer-to-peer platform for education and training:

“We’re looking at a mentor model where we’d have experienced members mentor and give advice to younger ones.”

Jeffrey Pang, Breeze

Facilities and Equipment

With gig workers everywhere, the gig workplace is also everywhere, changing the relationship between workers, their equipment, and their work facilities.

This relationship is at the heart of the traditional definition of an independent contractor—for example, a plumber who shows up with his own truck and his own tools to fix the sink in your office is clearly not an employee—the fact that they have invested in their own equipment is part of what defines them as an independent small business in the eyes of the law.

But the growth of on-demand and gig work has further stretched this relationship. It’s possible to participate in the gig economy with as little as a smartphone and a car, and work can take place far outside the boundaries of the traditional workplace.

Serving the equipment and facilities needs of gig workers essentially boils down to micro-leasing. This is not a new idea, but is one that is spreading more broadly into the workforce.

For example, Breeze is a short-term auto-leasing program targeting on-demand drivers. They offer a fleet of Toyota Prius vehicles that can be leased on a weekly basis, for a one-time signup fee of $250, plus roughly $200 per week9 (not including insurance or gas). Of course, taxi leasing is not new: most traditional taxis are leased to drivers on a daily or weekly basis, at a cost of roughly $150 per day.10

Beyond the basic function of providing a vehicle, Breeze positions itself as an advocate for the driver, helping to onboard them into the gig economy and help them succeed:

“Our differentiation and mission is that we’re really a one-sided platform, meaning we’re focused on one customer, who is our driver or who we call our member. Our focus is providing them with the best experience, helping them maximize their income with our Success team.”

Jeffrey Pang, Breeze

Breeze is deeply integrated into the worker’s finances, channeling their on-demand direct deposit income into a Breeze account, from which Breeze takes its fees:

“Our members receive their earnings in this bank account and the weekly fee that we collect comes out of it. This was born out of a customer request. We set up a payment system that allows folks to pay with their earnings rather than having to worry about the balance on their debit cards or checking accounts. It’s a convenience.”

Jeffrey Pang, Breeze

While such an arrangement could evoke the bad old days of the company store, it also solves a very practical problem for workers in the gig economy, which is a lack of a formal credit rating and access to traditional forms of credit.

Beyond vehicles, there are several services emerging to serve the need for physical space. ReCharge, Breather, and CoPass (none of which were interviewed for this report) all offer variations on a model of flexible space for independent, on-demand, and mobile workers.

Of these, ReCharge is both the newest (currently in closed beta) and the one most directly serving gig workers. Their tagline is “24/7 on-demand breaks within 30 seconds. Finally, a place in the city to get back to 100%.” They are clearly responding to the challenge that gig workers—especially those who are traveling throughout the city—don’t have access to a traditional “break room.”

Policy Implications

While this report focuses on market actors working on behalf of gig workers, it naturally intersects with questions of public policy.

A small number of policy questions and ideas stand out to us from our discussion of worker rights, worker power, and the viability of the social safety net in the gig economy.

Is the “Gig Economy” Here to Stay, or Is It Just a Fad?

We asked every company and organization whether they believe the “gig economy” is part of a profound, long-term trend, or is more of a passing fad. This question is central to policymakers who need to decide how much attention to pay to this emerging issue. Some of the notable answers are below:

“I think the market we’re serving has been around since around the 50s. It’s a $160 billion market in the States only, probably growing to over $200 billion by 2020. It’s 3 million temp workers a week. And then there’s an additional market that has come into existence and that I think is here to stay. [But] I think there’s a scalability challenge with purely on-demand gigs.”

Michele Casertano, BlueCrew

“I think it’s here to stay. I think traditional employment is going to be increasingly gig-ified. We see even the employee networks that are growing from traditional employers right now as future gig workers. Because it’s a pretty convenient model for employers and for workers, in some ways, to manage systems and pass distribution through platforms vs through traditional managers and corporate forums. I think we’ll see this structure be infused in all levels of employment.”

Michelle Miller, Coworker.org

“We could talk about a new unemployment system. We could talk about a new portable benefits system. We could talk about an end to wage theft. But I think what is really missing is—to the credit of the technology community, I think they are starting to understand that there is this thing called the gig workforce.

I was just at the White House yesterday. President Obama is starting a White House conversation [about the Gig Economy]. So, what we’re going to need to do now is start to bring all the players together. And get elected officials and cities and states and the federal government to start to realize that gig workers are not artisanal yuppies. They sit across the economic spectrum and they cannot be ignored.”

Sara Horowitz, Freelancers Union

“Dependent Contractor” Status: A Viable Third Way?

Front and center is the question of whether the current system of worker classification is relevant to the gig economy, or needs to be reworked somehow.

The idea that came through most consistently was that while creating a third classification (such as “dependent contractor” status) could hold promise, it could also lead to further gaming of the classification system. And rather, attention should be paid to how we might attach benefits and protections to workers, regardless of classification. Notable comments from the companies profiled here include:

“I don’t know if we need a new classification, but we need more clarification on IRS rules and regulations and how they should be applied to a labor force that hasn’t been measured in 10 years…. The lines are squiggly right now and we’ve got to figure out where they are before we can say there should be a reclassification. And ideally benefits wouldn’t be tied to classification. There are good benefits that come with classification and that’s what we should deal with right now: How do you create that protection in this new labor economy?”

Noah Lang, Stride Health

“I previously thought that something in the middle, like a dependent contractor [status], was the way to go. But as I actually sat down and articulated what that meant, I [realized] still would want independent contractors to get benefits. So, as opposed to creating this new classification, I think we would get a lot of mileage out of updating the independent contractor [status] to allow companies to contribute to that benefit.”

Shelby Clark, Peers

“I’m committed to the expansion of employment classification to make access to the social safety net available to all workers, regardless of classification. I think the 1099 vs W2 argument is an easy argument to have and an important one to figure out, but just the beginning of things we need to wrestle with in terms of what workers are dealing with and trying to navigate power in this system.”

Michelle Miller, Coworker.org

“I think what’s really important is that all workers should be treated the same. We have to get to that point. Right now, the current definitions really are not helpful for people. What’s really true is that work is increasingly flexible. It comes in gigs. We have to start figuring out how do we make these jobs sustainable.”

Sara Horowitz, Freelancers Union

A related notion that was frequently discussed is decoupling benefits from employment.

Michele Casertano from BlueCrew notes that while the Affordable Care Act took some good steps to decouple health benefits from full-time employment, it still doesn’t go far enough to support the heterogeneous employment model of the gig worker:

“Then there’s the impact of the Affordable Care Act. It’s not very on-demand friendly. They’re like, this guy works more than this amount of hours, he’s full-time, so you’ve got to offer him healthcare. And I’m like, I’m purely on-demand, so maybe this guy works full-time for me for 3 weeks, but then he disappears for a month and then he comes back. I want to be compliant but I don’t want to get in a situation where someone signs up for a day and gets healthcare and then disappears. Because I don’t force anyone to work.”

Michele Casertano, BlueCrew

Access to Data as a 21st-Century Worker’s Right

Data is at the center of the gig economy: powering the “trust and safety” engine that makes transacting with individual strangers possible. It’s also at the center of many regulatory issues outside of labor concerns, for example impacts on traffic, housing, and food safety.

Data is also central to worker power in the gig economy, including, but not limited to, the potential ability for workers to take their identity, reputation, and work history with them from platform to platform, increasing competition in the market. Some comments on this idea:

“So what influences the bargaining power in the future that determines how these marginal dollars get split? I would suggest that it is information. To the extent that the marketplaces have a lot of information and each participant (e.g., driver) has only very limited information the bargaining will heavily favor the marketplaces. One might argue that there could be competition between marketplaces, but due to network effects there are likely to only be a couple of big ones that matter.

There is a simple and universal regulatory change that would dramatically shift the bargaining power: an individual right to an API Key. By this I mean a key that would give an end user *full* read/write access to the system including every action or screen the end user can take or see on the web site or application. Alternatively one could think of this as an individual right to be represented by an algorithm.”

Albert Wenger: Labor Day: Right to an API Key (Algorithmic Organizing)

“One of the issues today is there’s no transparency. As a worker, because of the silo effect, they actually don’t know if they’re maximizing their earnings. Let’s say Postmates pays $10/hour, they can’t tell whether that’s good or bad, based on demand. Dispatcher, eventually, will give them that visibility in terms of what their labor is worth at this particular time.”

Robert Yau, Dispatcher

Data-Centric Regulatory Reform

Strategically requiring open data can help open up markets. For example, the stock market wouldn’t function without SEC-mandated disclosures. Similarly, targeted transparency in the labor regulations space can cause the labor market to function more effectively. For example, Noah Lang from Stride Health points out how requirements for machine readable data about health plans in the Affordable Care Act made it possible for them to build their health plan matching system and doctor database:

“The ACA restructured the way data is delivered in this space. So we had an opportunity to come in with fresh eyes as a new player and figure out how to take this newly available health plan benefits data, which before was not machine readable, you know, was free-form content, and borrow from data that was re-architected in the HITECH Act. That made it possible to build a really efficient doctor network database.”

Noah Lang, Stride Health

Another impact of applying 19th- and 20th-century labor regulations to digital work platforms is speed and ease of use. To a degree, work platforms opt toward a 1099 because of the transactional costs and friction of filing W2-related employment paperwork. Any efforts to turn burdensome, costly, paper-based or in-person regulatory processes into digital, instant, API-driven processes could incentivize work platforms to adopt a W2 model and its inherent protections.

“As a W2 employer, I have to get 100% of my workforce to verify documents. As a contractor, I don’t. The question is, why can’t I verify remotely? Is there really an advantage of me seeing you face to face and you saying, “OK, I authorize this. It’s real”? Why can’t I do it with pictures to an app? They say, “You can use a network of notaries.” But, then, every time you verify a document, a notary will ask you for $75. Can you imagine that? Every time I’m onboarding someone, he or she has to make an appointment with a notary and has to pay $75? That seems pretty much unreasonable.”

Michele Casertano, BlueCrew

Conclusion: This Is Just the Beginning

As we can see, the expansion of the gig economy, and the more profound shift toward the unbundling of the traditional job, has put pressure on our traditional support systems for workers, and has even challenged the definition of a job.

The landscape is very much in flux: on the legal side, as various employee classification lawsuits play out, on the policy side, as lawmakers wrestle with how to address this shift, and in the market, as worker-oriented support services continue to launch, grow, and experiment with a wide variety of approaches.

Perhaps the most interesting area to watch will be places where work platforms (such as TaskRabbit, Lyft, etc.) find alignments with worker support platforms that afford them both the protections they need. For example, job discovery platforms, fully realized, have the potential to prove that there’s a true “marketplace” at work (supporting the 1099 argument), as opposed to platform-controlled work services (which look more like W2 services). In their own ways, many of the worker support platforms profiled here are seeking such synergies.

For policymakers, the challenge will be to preserve the genuine benefits of the gig economy (an open market for work, personal control over time, etc.) with the need to ensure that all workers have access to the social safety net. This will no doubt take time to figure out. Fortunately, many people and organizations, including the small sample profiled here, understand this balance and are working hard to find solutions that fit.

1http://www.dol.gov/dol/topic/wages/overtimepay.htm

2http://www.dol.gov/oasam/programs/history/herman/reports/futurework/conference/staffing/9.7_discrimination.htm

3https://www.osha.gov/law-regs.html

4This applies to businesses with 50 employees or more. Details here: http://c.ymcdn.com/sites/www.familyenterpriseusa.org/resource/resmgr/Legislative_Updates/Health_Care_Reform_-_Employe.pdf

5https://en.wikipedia.org/wiki/Workers%27_compensation

6https://www.workplacefairness.org/independent-contractors#11

7https://en.wikipedia.org/wiki/Disability_insurance

8https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Understanding-Employment-Taxes

9Actual price varies by location.

10http://www.yellowcabnyctaxi.com/nyc-taxi/shift-life-cab-driver

Company Profiles

BlueCrew

Palo Alto, CA

Founded: 2015

Job discovery and scheduling

Tagline: Find work that fits you. Build a flexible career with BlueCrew.

Michele Casertano likes to use the phrase “staffing as a platform” to describe his company BlueCrew. The startup provides workers to companies on a temporary basis, similar to staffing agencies. But compared to traditional staffing agencies, BlueCrew uses a more data- and technology-driven approach. For example, every BlueCrew worker has an online profile, complete with job history, that employers can view. Workers are also dispatched to jobs automatically, based on BlueCrew’s proprietary algorithms. As Casertano, who cofounded BlueCrew and serves as its CEO, explains, “We’re a technology platform with a staffing marketplace.”

BlueCrew aims to reduce the inefficiencies of traditional staffing while increasing protections for independent workers by giving them workers’ compensation insurance and a pathway to health benefits. “Before BlueCrew, if you wanted to work, to temp and do purely on-demand work, you went to a staffing agency,” says Casertano. “And eventually they would call you on the phone if a job was there. But most of the time they disappear.” BlueCrew has expedited this process so that jobs can be filled in as little as one minute. When workers’ profiles match with available jobs, they receive alerts on their phones along with details about the assignment’s duration, location, and pay rate. If the job interests them, workers accept the assignment within the BlueCrew app by pressing a button.

Tasks range from warehouse tasks, such as packing boxes and driving forklifts to commercial moving, data entry, and customer support and are currently based in the Bay Area. Assignments can be as short as a few hours and as long as two months. Some companies also hire full-time workers through BlueCrew. Casertano says workers on the platform number in the “high hundreds.” His goal: to become “the leading [job discovery] platform for the temporary and flexible workforce, in general.”

Interestingly, BlueCrew’s model relies on hiring its workers as W2 employees. Casertano says he does this so he can cover his workers with workers’ compensation insurance. He also believes that his workers get a “better deal” by being W2 employees because BlueCrew handles their tax withholding, including the Federal Insurance Contributions Act (FICA) tax, which funds Social Security and Medicare. BlueCrew doesn’t give its workers health insurance automatically, but they can qualify for benefits after working more than 30 hours per week for 90 days.

Though Casertano admits that he sometimes worries about his employees’ “career growth,” he says it’s important to simply give people—particularly people who don’t have ready access to many jobs—an opportunity to work. “Some people decide this should be their main source of income,” he adds. “They refer to themselves as BlueCrew workers. They’ve created their own culture of why they’re temp workers.”

Breeze

San Francisco, CA

Founded: 2013

Facilities & Equipment, Job Discovery & Scheduling

Tagline: Get a car. And get paid.

Ride-sharing and delivery jobs are the most popular gig economy tasks, but are typically accessible only to drivers who have cars insured under their own names. As a result, people who struggle to finance cars may find themselves shut out of platforms such as Uber and Lyft. Breeze addresses this issue by leasing cars to independent workers. Members pay Breeze a one-time membership fee ($250) and a weekly leasing fee ($195). In return, members receive a Toyota Prius they can personally insure and use 24/7 for their gig economy work.

Breeze is much more than a car-leasing company. It also employs a “Member Success” team that counsels users in-person and over the phone about which gig economy jobs best fit their preferences, how many hours they should work a week at minimum, and how much they can expect to earn after expenses. Since 80% of Breeze’s new members are gig economy novices, the guidance prepares members for the realities of gig work and helps ensure they’ll be able to make their lease payments. As Breeze cofounder Jeffrey Pang explains, “A big part of our onboarding is checking all the boxes to make sure you qualify for these income streams. The last thing we want is for you to get a car and be like, ‘Wait, what do I do with this thing? I can’t make any money with it.’”

Breeze attracts two main types of users: people who have poor or no credit and people who don’t want to commit to a three-year lease or a five-year loan in order to get a vehicle to earn income. In keeping with the flexibility of gig economy work, Breeze lets users leave the program anytime, as long as they have completed at least one month of payments and give the company two weeks notice. Breeze leases are also geared toward lots of driving with an annual mileage cap of 30,000, which is two to three times more than what traditional car leases allow.

Breeze has no formal affiliation with any of the gig economy platforms. Its members hold an assortment of driving-centric jobs, from ride-sharing to grocery and meal delivery and home-cleaning services. Pang says Breeze’s “openness” and support for a range of jobs differentiates it from Uber’s leasing program, Uber Xchange.

Since Breeze makes it possible for more people to take up gig work, Pang sees the company as an enabler for the broader gig economy. “We are the financial backbone for a growing percentage of the gig economy,” he posits. “We’re accelerating and enabling access for our members who would otherwise lack the ability to get car ownership or for whom committing to a term loan didn’t make sense.”

Breeze is currently available in six U.S. cities (Boston, Chicago, Los Angeles, San Francisco, Seattle, and Washington, D.C.) and will open soon in San Diego.

The Great Unbundling

We are in the midst of a great social and economic shift. Global, mobile connectivity and ubiquitous data are steadily restructuring not only our interpersonal relationships, but our economic and industrial systems. This great reshaping has often been referred to as unbundling—the breaking up of previously understood packages of goods and services into their component parts, eventually to be rebundled in new ways.

We are familiar with the unbundling of the media and publishing industries—from triple-play cable packages to Internet + Netflix + Amazon + AppleTV; from compact discs to MP3 downloads, to streaming services; from print newspapers and books to blogs and eBooks—and the same is steadily happening to every other economic and industrial sector.

It’s even happening in highly regulated sectors such as transportation (ride-sharing), housing (home sharing), finance (peer-to-peer lending, crowdfunding, Bitcoin), and health (telemedicine, personal sensors, home diagnostics), where the regulations that shaped these sectors in the 20th century are coming under intense pressure to adapt.

This great unbundling means that products and services are often much more accessible, in much smaller pieces, and from a greater number of providers.

What is true from the consumer’s perspective is also true from the worker’s perspective: work is now more accessible than ever, but it’s coming in a different form. Rather than a single job from a single employer, we now have access to many jobs from many sources, in many shapes and sizes. As this happens, the very notion of a “job” is being unbundled into its component parts.

The Unbundling of the Job

So, what’s in a job, exactly? What are its component parts? How are they coming unbundled?

Author Nick Grossman’s colleague from Union Square Ventures, Albert Wenger, describes it as such:

“Do people need jobs or can we deliver what jobs provide some other way and in a potentially unbundled fashion? The “jobs of a job” include income, structure, social connections, meaning, and at least in the US, access to healthcare.”

In other words, the things we’ve come to think of as the components of a “job” aren’t inherently bound together. And indeed, the unbundling of the job means that each of these components, and more, are becoming available from new places, and are able to be bound together in new ways.

Later in the report, we’ll look in detail at the following components of the work bundle:

- Job Discovery and Scheduling

- How one finds work and manages his/her time

- Finance and Administration

- Managing money and admin tasks such as paying taxes

- Benefits and Insurance

- From healthcare, to worker’s comp, to retirement

- Identity and Reputation

- Both are critical to succeeding in the gig economy

- Community and Organizing

- Modern versions of the water cooler and union hall

- Education and Training

- Skills development, just as with work, comes from many sources

- Facilities and Equipment

- Rethinking what it means to be “in the office”

Much attention has been paid to the first component, which is essentially income. Independent from the other previously bundled components of “a job,” it’s easier than ever to find sources of income online. A major force here is the “platformization” of work, meaning the emergence of web and mobile job marketplaces and work platforms such as Amazon’s Mechanical Turk, the freelancer marketplace Upwork, and on-demand service platforms such as Uber, Handy, and Doctor on Demand.

Online work platforms build on top of these fundamental trends and provide two primary services: first, making markets, cultivating and sustaining both supply and demand; and second, establishing “trust and safety” systems (such as escrow, reputation, insurance, and acceptable use policies) that ensure the smooth operation of the marketplace.

Such platforms are not the underlying cause of the shift, but are rather an accelerant. There are more fundamental drivers of this shift:

- The web and mobile connectivity that enables more direct, person-to-person transactions of all types.

- The age-old push of corporations to lessen their reliance on full-time workers, and increase the utilization of part-time and contract workers, for cost-saving reasons.

All told, these forces are drawing more and more people into the part-time labor force, aka the “gig economy.” According to a recent study by Freelancers Union and Upwork, in 2015, nearly 54 million Americans—roughly 34% of the US population—participated in some form of freelance work, and the trend is accelerating year over year.

Aside from the income component of the job bundle, which has seen enormous experimentation and growth in the past decade, we are now beginning to see the emergence of the other parts of the bundle. That’s what this report will focus on—the tools and services that gig workers might begin to rely on to fulfill the set of needs that was previously fulfilled by a full-time job.

We should note that the “gig economy” is not monolithic. It includes work that is both low wage/commodity (such as driving and traditional hourly shift work), as well as high-end and specialized (such as graphic design and medical services). It includes work that looks more like “a job” (such as delivering food) and work that looks more like a “micro-business” (such as producing and selling craft goods).

“The things that stress out Gig Economy individuals are largely the same stresses suffered by someone who works at Target or in a pretty traditional service employment capacity.”

Quinten Farmer, Even

At the same time, many of the same considerations apply throughout the “gig economy,” the most fundamental being a less stable source of reliable income, and less access to traditional benefits and protections.

The Gig Worker’s Dilemma

“As an independent worker, all this infrastructure and stuff used to be taken care of by a company and now you have to figure it out on your own. And it can be impossible to solve.”

Shelby Clark, Peers

The heart of the challenge of being a gig worker is that you’re on your own. No single employer is responsible for you or to you. You’re no one’s responsibility, except your own. This means that it’s up to you not only to find work and stay busy, but also to manage all of the overhead that comes with being a worker, “business owner,” and taxpayer. If we imagine all of the support services that were previously bundled with full-time employment—from steady employment and income, to navigating the federal and state bureaucracies, to providing benefits and insurance—all of that now falls on the worker directly.

Looking at the job bundle outlined above, the job-related components of the social safety net are of critical importance. Traditionally, much of that safety net—in particular, benefits such as unemployment, disability, retirement, and worker’s comp—have come from employers, based on the assumption that people will have a single employer with whom they have a long-term, monogamous relationship.

But as work becomes unbundled, the underlying assumption that the social safety net can stay bundled to the job is being challenged.

For reference, below is a brief review of the primary benefits and protections that have traditionally been bundled with employment:

| Steady income | The foundational need to have steady, reliable income, to support basic needs. Traditionally, firms have shouldered this risk and hired accordingly. |

| Minimum wage | Price floor for wage labor, intended to ensure a minimum standard of living. |

| Overtime pay | Employees are typically entitled to 1.5 times pay for work exceeding 40 hours per week.1 |

| Antidiscrimination | The Civil Rights Act and the Americans with Disabilities Act prohibit hiring discrimination on the basis of race, color, sex, ethnic origin, and disability, respectively.2 |

| Workplace health and safety | The Occupational Health and Safety Administration (OSHA), a part of the US Department of Labor, specifies workplace safety standards and regulations.3 |

| Healthcare | Medical, vision, dental. Employers are required to offer affordable (<= 9.5% of take-home pay) health plans to employees working 30 hours per week or more.4 |

| Workers’ compensation | Wage replacement and medical coverage for on-the-job injuries; typically offered in exchange for releasing employer from liability.5 |

| Unemployment | Wage replacement during times of unemployment. Typically paid for by employer. Independent contractors must pay into their home state’s unemployment fund.6 |

| Disability insurance | Paid sick leave, short-term and long-term disability payments. Typically paid by employer. Independent contractors may purchase their own insurance.7 |

| Professional liability insurance | Protects companies and independent contractors from liability claims arising from services performed. Also known as errors and omissions (E&O) insurance. |

| Retirement savings | Savings plans featuring tax-advantaged contributions and often featuring employer contributions. |

| Payroll taxes | Bundle of employer contributions and employee withholdings, contributing to Social Security, Medicare, unemployment, and other programs; handled by employer at payroll time.8 |

| Training | Employers often provide employees with training programs, but are limited in doing so for independent contractors. |

| The right to organize | Workers have the legal right to organize for negotiating leverage with employers. Independent contractors may not do so out of antitrust concerns. |

| Various other protections at the state level | Labor laws vary greatly on a state-by-state basis. |

Because these protections have been traditionally bundled with work and are typically handled seamlessly within a firm, they have become almost invisible and taken for granted, so many workers may not even know what they’re missing when they switch away from traditional employment status.

As more workers shift from traditional employees to gig workers, the responsibility of reassembling these protections falls to them. In other words, a gig worker is like a tiny, one-person company, responsible for creating his or her own personal HR department.

This constitutes both a massive shift in risk, a steep learning curve on the part of gig workers, and a fundamental restructuring of the worker support ecosystem. While this initially exposes gig workers to significant risk, it also opens up the market for a new generation of worker support services, which is what this report will explore.

Worker Classification: W2 Employee vs 1099 Contractor

Central to the public debate around the gig economy has been the issue of worker classification.

All labor laws, at the federal and state level, are built around the idea of a core distinction between employee and independent contractor, where employees (W2 status) receive all of the benefits outlined in the previous section, and independent contractors (1099 status) receive none.

This distinction made sense in a world where you were either a full-time, dedicated employee (factory worker or executive), or a real standalone personal business (plumber or doctor), but becomes problematic as the gig economy grows.

At the heart of this distinction is the notion of control: how much control does the labor buyer (employer, client) have over the labor supplier (employee, contractor)? The more that control is exercised—in the form of scheduling, behavior specification and training, rate setting, etc.—the more the law views that as an employer/employee relationship. The less control that is exercised, the more the law views the relationship as between an independent contractor and their client.

The IRS breaks down the question of control into three sections:

| Behavioral Control covers facts that show if the business has a right to direct and control what work is accomplished and how the work is done, through instructions, training or other means. |

Financial Control covers facts that show if the business has a right to direct or control the financial and business aspects of the worker’s job. This includes:

|

Relationship of the Parties covers facts that show the type of relationship the parties had. This includes:

|

| IRS Topic 762 – Independent Contractor versus Employee |

As we consider these distinctions in the context of the unbundling of the job, they become much more fuzzy and much less effective at protecting workers.