Chapter 1. Think like a Fundamentalist

"If you are going to own a stock... it should be a good one!"

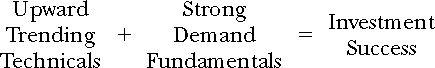

Equation 1.1.

Rule 1 is about stock selection. It could be titled the "What to Buy" rule. Buying fundamentally strong companies will lower your risk and improve your chances of generating significant and consistent profits. In this rule, you will learn why thinking like a fundamentalist is good, but trading like a fundamentalist is bad. In this rule, you will learn how to know what to buy, not when to buy. You will learn when to buy in Rule 3.

You will learn the importance of stock selection based on some, but not all, fundamentals. You may know a lot about fundamental analysis, or you may have no idea what the term means. Regardless, this is a must-read rule. Don't rush through it, and certainly do not skip it. This is a critically important rule.

When you learn the concept of thinking like a fundamentalist, you will be surprised at how easy and straightforward it is to use that thinking to vastly improve your ability to know just the right stocks to "consider" buying. The key is to own only fundamentally strong stocks, but you want to own them only at the right time.

You may already use fundamentals in your analysis of a company before buying the stock. If you do, that is good. If you don't, you soon will. Remember, half of your decision making about what to buy is based on fundamentals. ...

Get 10: The Essential Rules for Beating the Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.