INTEREST RATE COLLAR INSTRUMENT—AN ILLUSTRATION

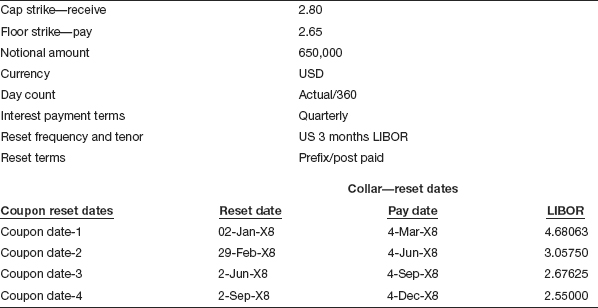

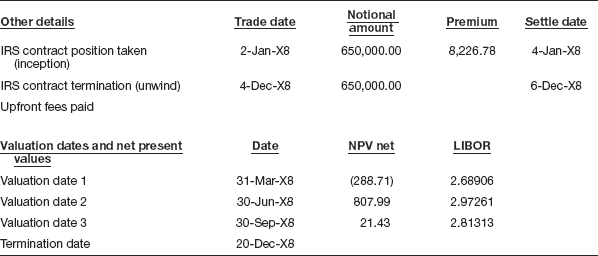

Tables 11.2 and 11.3 gives the details of interest rate collar instrument for the purpose of this illustration.

Table 11.2 Details of interest rate collar trade

Table 11.3 Other details for the interest rate collar trade

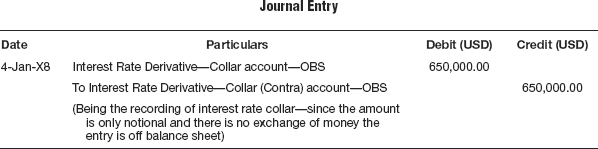

Recording the trade—contingent

This interest rate collar agreement is the simultaneous purchase of a cap and the sale of a floor for the same expiration, the length of the period and the contract’s notional amount. However, since this is just a notional amount and no physical exchange of money takes place, the off balance sheet entry to record the transaction is made in the book of accounts, as shown in Table 11.4.

Table 11.4 At the inception of the interest rate collar trade

Account for the premium if any on the trade

The cost of the collar is referred to as the premium. The premium for an interest rate collar depends on the rate parameters sought as compared to current market interest rates. The net premium can be reduced to zero by choosing the strike rates that allow for the cap and floor premiums to be equal. The premium can also be in the negative, meaning that to take a collar position the buyer of the instrument ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.