TRADE LIFE CYCLE FOR FIXED INCOME SECURITIES—HELD-TO-MATURITY

- Buy the bond

- Accrued interest purchased

- Pay the contracted amount for the bond

- Premium/discount on purchase

- Coupon accrual

- Coupon receipt

- Reversal of accrued interest purchased

- Amortization of premium/discount on purchase

- Accrual of interest on valuation date

- Valuation of bond on valuation date

- Sell the bond

- Interest on bond sold

- Receive the consideration

- Ascertain the profit/loss on the sale

- FX revaluation (for securities held in foreign currency)

- FX translation (for securities held in foreign currency)

Impairment of bonds

- Initial impairment

- Subsequent to initial impairment

- Receipt of proceeds of impaired bonds

- Write back upon declassification

- Write off

Additional possible events in the trade life cycle

- Revaluation

- Early redemption

- Maturity

- Write off

- Recovery subsequent to write off

Most of the events in the trade life cycle for fixed income securities classified as held-to-maturity are covered in the earlier two chapters. The additional events associated with this form of investments are discussed below.

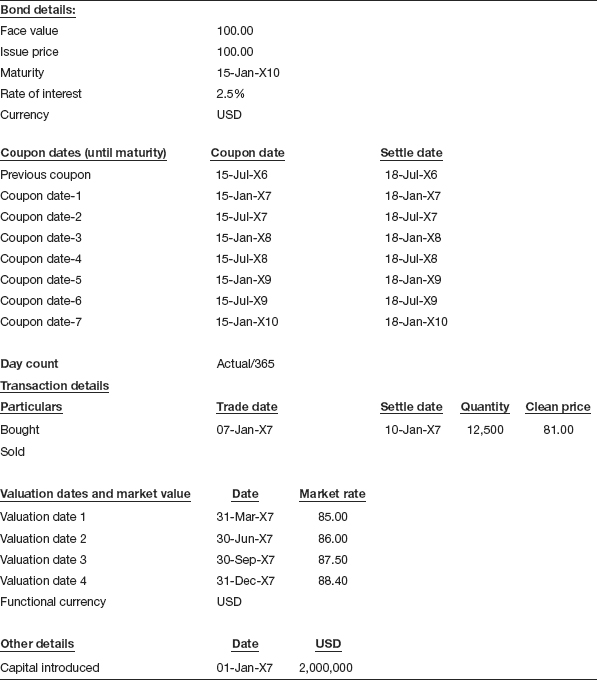

Let us assume the details as shown in Table 4.2 for the purpose of this illustration.

Table 4.2 Trade and other details for the purpose of illustration

Premium/discount on purchase of the security

The premium or discount on purchase of the security is recognized on purchase of the security. A contra entry is passed ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.