ILLUSTRATION OF BONDS HELD-TO-MATURITY—COMPLETE SOLUTION

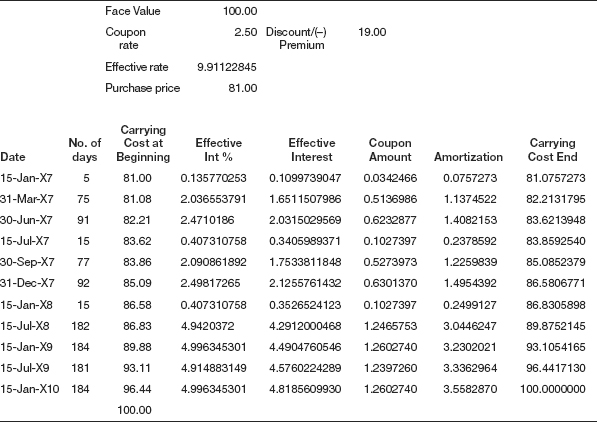

The first step is to prepare the amortization schedule as shown in Table 4.3. The objective is to compute the effective interest rate and also the amortization factor for each period until the maturity of the bond. As mentioned earlier, the effective interest rate is computed based on an iterative process in such a way that the net present value is zero.

Table 4.4 Computation of amortization and carrying cost

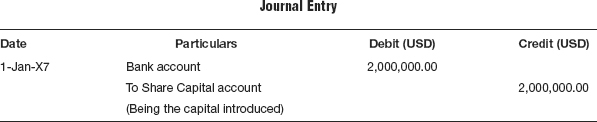

T-1 On introducing cash into the fund:

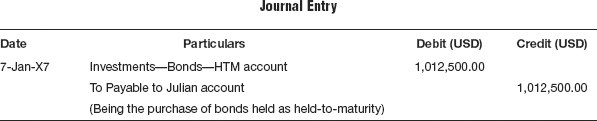

T-2 On purchase of Bonds—HTM:

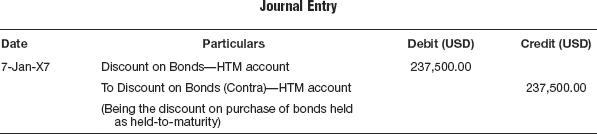

T-3 On accounting for premium/discount on purchase of Bonds—HTM:

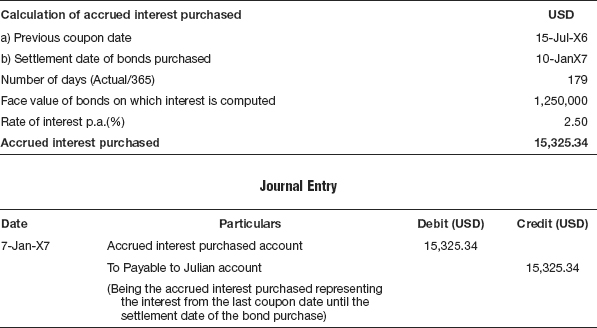

T-4 On recording accrued interest purchased on purchase of Bond:

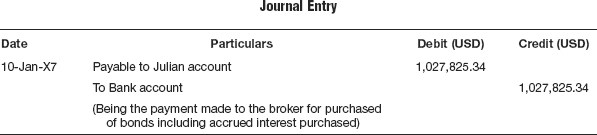

T-5 On payment of contracted sum:

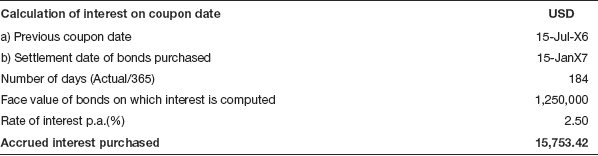

T-6 On accounting for interest on coupon date: (T-6 @ FX Rate: 1.000000)

T-7 On reversal of ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.