Yields to Maturity on Zero-Coupon Bonds

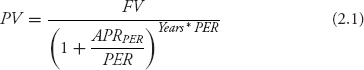

After dealing with money market interest rate calculations in Chapter 1, zero-coupon bond yields are a welcome relief and a return to classic time-value-of-money theory. A pricing formula for zeros is shown in equation 2.1,

where PV = present value, or price, of the bond, FV = future value, which usually is 100 (percent of par value) at maturity, Years = number of years to maturity, PER = periodicity—the number of periods in the year; and APRPER = yield to maturity, stated as an annual percentage rate corresponding to PER.

We can now use equation 2.1 to illustrate the yield calculations for the two TIGRS. ...

Get BOND MATH: The Theory Behind the Formulas now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.