More Applications for the Implied Spot and Forward Curves

Implied spot and forward rates need to be useful in making financial decisions to qualify as information and not just create more data. Fortunately, they really can be quite informative. An obvious application for bootstrapping the implied spot curve is to get the zero-coupon rates needed to derive the implied forward curve. That is, the implied spot curve can be just an intermediate step to get to get the information we need to help make a maturity choice decision.

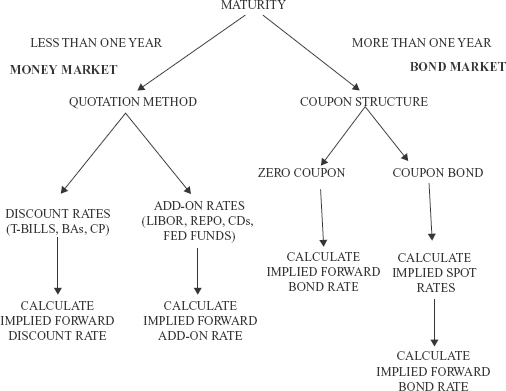

FIGURE 5.2 Summary of Implied Forward Rate Calculations

Figure 5.2 summarizes the various paths to the implied forward rate ...

Get BOND MATH: The Theory Behind the Formulas now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.