Curve Duration and Convexity

A number of versions of duration have been introduced since Macaulay first wrote down a formula for the statistic in the 1930s. I always wonder: Does this mean he invented it or discovered it? Anyway, another version that I'll call spot duration sometimes is used in academic fixed-income research.

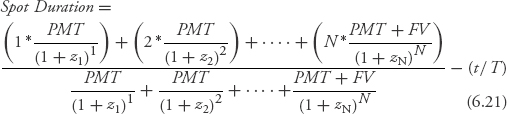

This looks much like the weighted-average formula for Macaulay duration in equation 6.14. The difference is that instead of discounting the cash flows with the yield to maturity, the sequence of spot, or zero-coupon, rates (z1, z2, … , zN) is used. The price of the bond in the denominator is the same as in equation 6.14

Get BOND MATH: The Theory Behind the Formulas now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.