Yield Duration

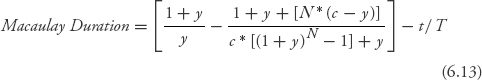

We can derive specific formulas for the various duration statistics by calculating carefully the first partial derivative of the bond pricing equation 6.1 with respect to a change in the yield per period. As much fun as it is to do the calculus and work though the ensuing algebra, the step-by-step process is relegated to the Technical Appendix. A general formula for the Macaulay duration statistic is shown in equation 6.13.

Here the coupon rate per period is denoted c, where c = PMT/FV.

Let's go back to the 4%, annual payment, 4-year corporate bond priced at 99.342 to yield 4.182% that we first saw in Chapter 3. Suppose that one ...

Get BOND MATH: The Theory Behind the Formulas now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.