23.6 THEORIES OF COMMODITY FORWARD CURVES

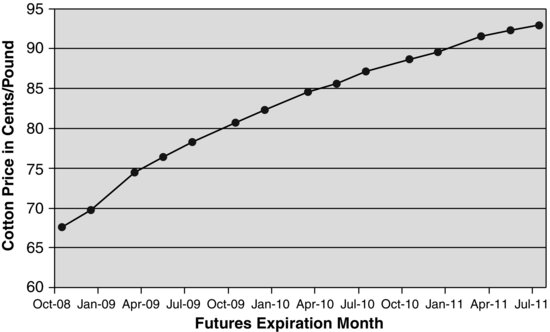

The price of a commodity for delivery in the future can be higher or lower than the price of that commodity for immediate delivery. When the price for delivery in the future (the future price) is higher than the price for immediate delivery (the spot price), we say that the forward curve is upward sloping. This is also termed contango, as illustrated in Exhibit 23.2.4 When the future price is below the spot price, we say the forward curve is downward sloping, or in backwardation.

EXHIBIT 23.2 Upward-Sloping Commodity Curve (Contango) ICE Cotton, September 1, 2008

Source: Intercontinental Exchange (ICE).

The theories for why commodity forward curves slope up or down are similar to theories that try to explain why yield curves slope up or down. In the context of commodity markets, nonspeculative or commercial accounts are typically segregated into producers and users of the commodity. In fixed-income markets, we can think of borrowers as producers of bonds, and lenders as users of bonds. To expand on this analogy, borrowers typically have a preferred maturity date in mind when issuing bonds, but are willing to shorten or extend that maturity date if market conditions dictate. Also, a borrower may increase the quantity of bonds issued if the price is attractive. Similarly, buyers of bonds (lenders) typically consider the prices of bonds with ...

Get CAIA Level II: Advanced Core Topics in Alternative Investments, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.