35.2 DIRECTIONAL CURRENCY TRADES

One would be remiss, in discussing the global macro strategy, to neglect to mention George Soros and the Exchange Rate Mechanism (ERM) crisis of 1992−1993. (See Exhibit 35.1.) This was likely the first time the general public became aware of the existence of global macro funds and their actions. This case study explains the discretionary, fundamental, information-based style of macro trading. In this case, the information used focuses on central bank policies and the level of currency reserves held by each country.

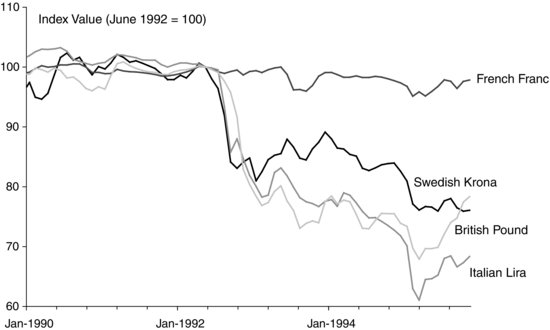

EXHIBIT 35.1 Evolution of Exchange Rates around the 1992 Crisis

The European Monetary System (EMS) was formed in 1979, by several European countries, to coordinate their monetary and exchange rate policies. Among other things, the EMS created a fictitious accounting unit called the European Currency Unit (ECU), using guidelines established by the ERM agreement. The ERM was essentially a managed floating exchange rate system, where the currencies of participating countries were allowed to fluctuate, within prespecified bands, around a reference point (±2.25% for most countries; ±6% for Italy, Spain, Portugal, and the United Kingdom). Central banks were charged with taking appropriate measures, whenever needed, to keep the exchange rate within these bands. Since the ECU was fictitious, in practice the unofficial reserve currency, the German ...

Get CAIA Level II: Advanced Core Topics in Alternative Investments, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.