CHAPTER FOUR

Introduction to Valuation Models

CHAPTER 4 TAKEAWAYS

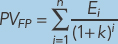

- The valuation model for an enterprise can consist of a series of cash flows or a combination of a forecast series followed by a post-forecast series of cash flows and is modeled by the expression

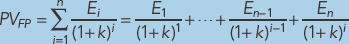

- The present value of forecast period cash flows is valued by

This in expanded form becomes

- Post-forecast-period cash flows can be valued a number of ways. The model selected depends on the assumptions made about the post-forecast cash flows.

- The five models together with the associated assumptions are:

(1) Perpetual Fixed Model (PXM)

![]()

This model assumes a fixed (constant) stream of cash flow that continues forever. It's hard to think of a company's post-forecast-period cash flows that would suit this model and therefore it's seldom if ever used.

(2) Finite Fixed Model (FXM)

![]()

Unlike the perpetual fixed model this model values a fixed cash flow stream for a finite period of NX years. Again it's unlikely to be a realistic prototype ...

Get Corporate Value Creation: An Operations Framework for Nonfinancial Managers now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.