CHAPTER 18

Interest Rate Products: Swaps

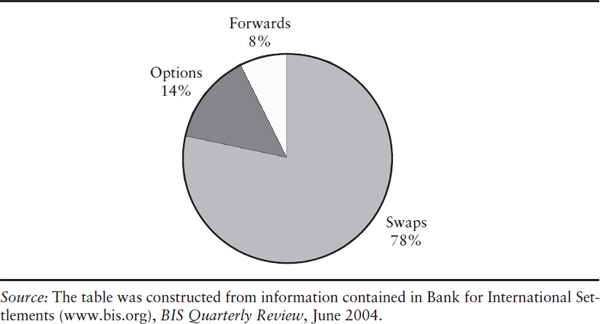

The first interest rate swap market originated in the early 1980s. An interest rate swap is an agreement between two parties to exchange or “swap” a series of periodic interest payments. The most common interest rate swap, a plain-vanilla interest rate swap, is an agreement to exchange payments on fixed rate debt for floating rate debt. An early example occurred in 1982 when Sallie Mae swapped the interest payments on intermediate-term fixed rate debt for floating rate payments indexed to the three-month T-bill yield. In the same year, a USD 300 million seven-year Deutsche Bank bond issue was swapped into USD LIBOR. While we discussed swaps on other types of assets in earlier chapters, interest rate swaps are far and away the largest asset category. As of yearend 2003, interest rate derivatives accounted for 72% of the notional amount of all OTC derivatives outstanding. Of this amount, more than 78% of interest rate derivatives were swaps, with the remaining 22% being split between options (14%) and forwards (8%) as is shown in Figure 18.1.

FIGURE 18.1 Percentage of total notional amount of single-currency interest-rate derivatives outstanding worldwide on December 2003 by contract type. Total notional amount of interest-rate derivatives is USD 141.99 trillion.

In general, this chapter deals with OTC interest rate products that have multiple ...

Get Derivatives: Markets, Valuation, and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.