6

“Moneyness”

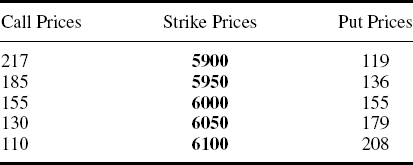

This chapter deals with some key everyday option language; the lingua franca of the options market. Specifically, we will consider the terms “in-the-money”, “at-the-money” and “out-of-the-money”. “The money”, in all of these cases, refers to the prevailing price of the underlying share or index, hence the chapter title of “moneyness”. Consider the set of prices in Table 6.1.

Note that the underlying FTSE future is trading at 6000. The “at-the-money” options are those with strike prices closest to this underlying price. In this case, then, the at-the-money options are the 6000 calls and puts. If the futures price was between two strikes, at 6022 for example, then the at-the-moneys would be both the 6000 and the 6050 calls and puts. In summary, the at-the-money options are those with strikes closest to the current price of the underlying.

“In-the-money” options are those that currently have intrinsic value. In-the-moneys are options that we would choose to exercise if they were expiring right now. From Table 6.1, the in-the-money calls are the 5900 calls and the 5950 calls. The in-the-money puts are the 6050 puts and the 6100 puts. All of these options, the 5900 and 5950 calls and the 6100 and 6050 puts, are exercisable with the future at 6000.

Table 6.1 LIFFE 3 month FTSE 100 option prices (LIFFE 3 month FTSE 100 future = 6000)

We talk about “deep” in-the-money options ...

Get Equity and Index Options Explained now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.