20

Long Strangles

What is a long strangle? Just like a long straddle, a long strangle consists of two legs, a long call and a long put. The difference is that whereas a long straddle consists of a put and a call with the same strike, a strangle consists of an out-of-the-money put and an out-of-the-money call. As with a long straddle, the options come from the same series and buying a strangle involves buying both of the options simultaneously.

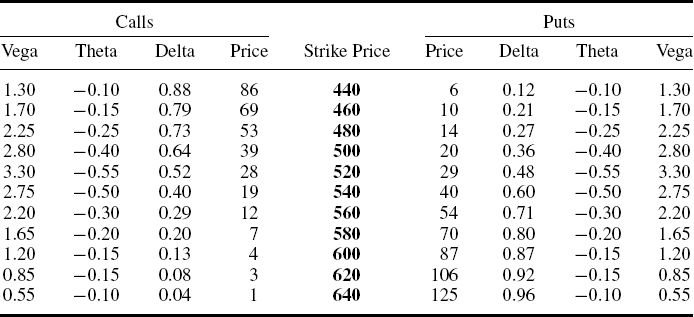

For example, from the matrix of Sep BP option prices (Table 20.1, repeated from Table 16.1), buying the 460/580 strangle consists of two legs, buying the 460 put at 10 and simultaneously buying the 580 call at 7. The cost of the strangle is 17 ticks (equivalent to £170) per strangle, the sum of the 10 paid for the 460 put and the 7 paid for the 580 call. These 17 ticks represent the maximum loss on buying the strangle. If BP is between 460 (i.e. £4.60) and 580 (i.e. £5.80) on Sep expiry, then both the 580 calls and 460 puts will expire worthless. The maximum possible value of the strangle is unlimited to the upside and limited only by zero to the downside.

Table 20.1 LIFFE Sep BP option prices and Greeks at close on 21 July 2008 (BP share price (LSE) = 522 (i.e. £5.22))

Note that the cost of the Sep 460/580 strangle is significantly less than the cost of the Sep 520 straddle. The strangle costs 17 against 57 for the straddle. In the case of ...

Get Equity and Index Options Explained now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.