DETERMINANTS OF TRACKING ERROR

Several factors affect the level of tracking error. The major factors include:

- Number of stocks in the portfolio

- Portfolio market capitalization and style difference relative to the benchmark

- Sector deviation from the benchmark

- Market volatility

- Portfolio beta

The impact of each of these factors is investigated in Vardharaj, Fabozzi, and Jones.1

Number of Stocks in the Portfolio

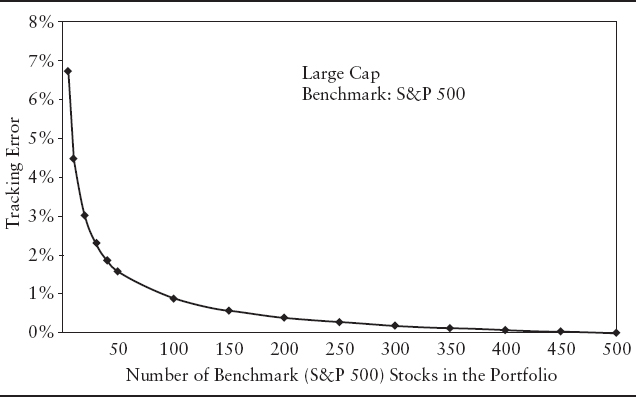

Tracking error decreases as the portfolio progressively includes more of the stocks that are in the benchmark index. This general effect is illustrated in Exhibit 10.2 that shows the effect of portfolio size for a large-cap portfolio benchmarked to the S&P 500. Notice that an optimally chosen portfolio of just 50 stocks can track the S&P 500 within 1.6%. For midcap and small-cap stocks, Vardharaj, Fabozzi, and Jones found that the tracking errors are 3.5% and 4.3%, respectively.2 In contrast, tracking error increases as the portfolio progressively includes more stocks that are not in the benchmark. This effect is illustrated in Exhibit 10.3. In this case, the benchmark index is the S&P 100 and the portfolio progressively includes more and more stocks from the S&P 500 that are not in the S&P 100. The result is that the tracking error with respect to the S&P 100 rises.

EXHIBIT 10.2 Typical Tracking Error vs. the Number of Benchmark Stocks in the Portfolio for the S&P 500

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.