ANALYSIS

How does constraining shortfall beta as shown above improve performance? The shortfall constraint forces the manager to adopt certain positions to limit the exposure to extreme losses. To better understand this, we decompose the active portfolio into positions due to the manager's alpha and positions taken to satisfy individual constraints. This decomposition is based on the portfolio optimality conditions.7

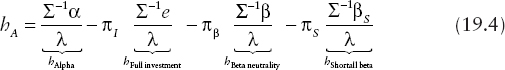

We can express the active portfolio as the sum of four component portfolios:

where hA represents the active holdings and πI,πβ,πBS are the shadow prices8 of the full investment, beta and shortfall beta constraints, respectively. Equation (19.4) shows the portfolio can be decomposed into the positions due to the manager's alpha (hAlpha) and the positions taken to satisfy the three constraints—hFull investment, hBeta neutrality, and hShortfall beta.

The alpha portfolio is the portfolio in which the manager would invest in the absence of constraints. Each constraint portfolio—full investment, beta neutrality, and shortfall beta—contains the additional positions needed to satisfy that constraint in a way that maximizes portfolio utility. We define the return due to each of these sources as the return of the corresponding portfolio.

Exhibit 19.6 shows a return decomposition for the relative strength strategy implemented with standard mean variance optimization. The active ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.