APPENDIX: CASE STUDY

Coca-Cola: Integrated Traditional and VBM Analyses

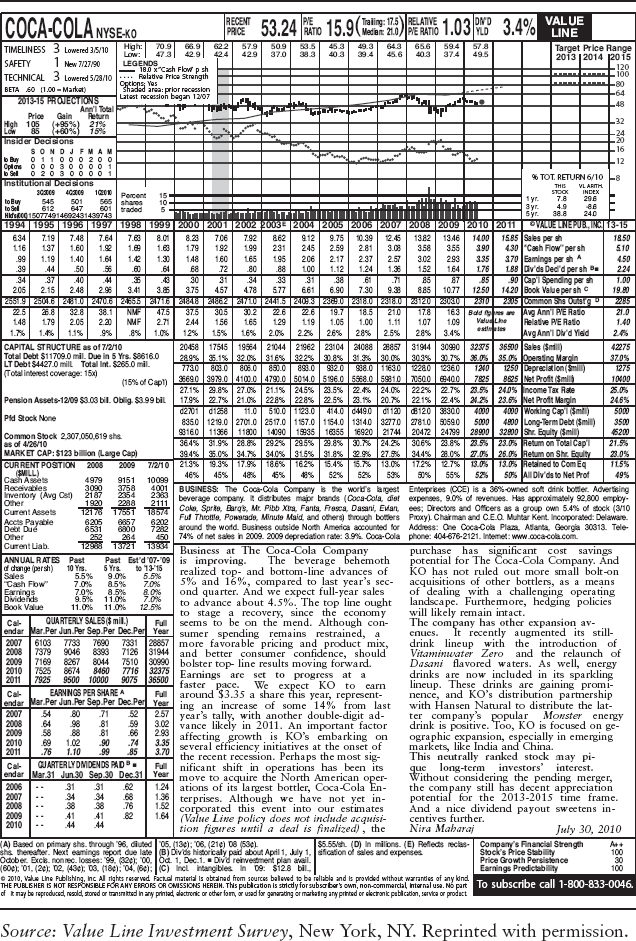

In the appendix, we provide an integrated fundamental analysis of Coca-Cola Company (KO) using traditional and value-based metrics. Financial data for KO are drawn from the Value Line report shown in Exhibit 2.A1. An overall fundamental evaluation of the soft drink company is provided using the Timeliness (expected performance) and Safety (risk) rankings employed by Value Line. A Timeliness score of 1 means high expected stock performance, while a score of 5 means low expected stock performance over the next 6 to 12 months. A Safety score of 1 means high expected safety (low risk), while a score of 5 means low expected safety (high risk). A comparative rating using this system is also provided for a hypothetical analyst. The accompanying equity analysis of Coca-Cola is conducted using financial software developed by JLG Research and consists of three parts, shown in Exhibit 2.A2:

- Evaluation of Expected Performance (timeliness)

- Evaluation of Expected Risk (safety)

- Equity Fundamental Summary and Rating

The usual caveat applies to the case study: Past performance is no guarantee of future performance, and investors should seek professional and legal guidance when buying and selling securities.

EXHIBIT 2.A1 The Value Line Report

EXHIBIT 2.A2 JLG Equity Analysis Template*

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.