HYPOTHETICAL EXAMPLE

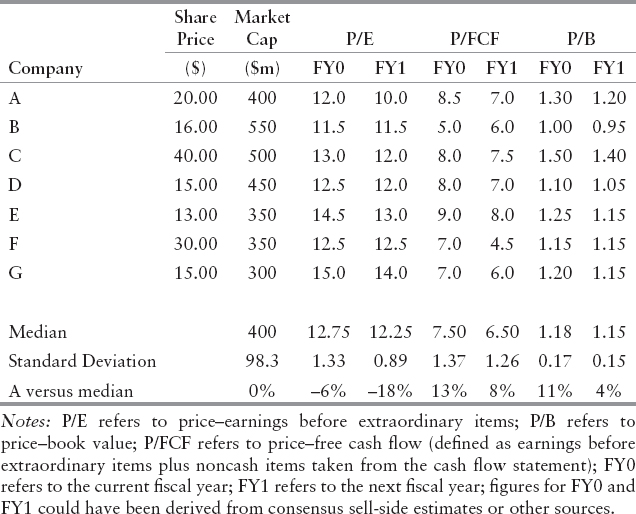

Suppose that an analyst is seeking to gauge whether Company A is attractive or unattractive, on the basis of relative valuation methods. Suppose that the analyst has determined that there are six other listed companies in the same industry that are approximately the same size and comparable in terms of product mix, client base, and geographical focus.20 Based on this information, the analyst can calculate some potentially useful multiples for all seven companies. A hypothetical table of such results is shown in Exhibit 4.1. (For the purposes of this simple hypothetical example, we are assuming that all the firms have the same fiscal year. We consider calendarization later in this chapter.)

EXHIBIT 4.1 Hypothetical Relative Valuation Results

In this hypothetical scenario, Company A is being compared to companies B through G, and, therefore, Company A should be excluded from the calculation of median and standard deviation, to avoid double-counting. The median is used because it tends to be less influenced by outliers than the statistical mean, so it is likely to be a better estimate for the central tendency. (Similarly, the standard deviation can be strongly influenced by outliers, and it would be possible to use “median absolute deviation” as a more robust way of gauging the spread around the central tendency. Such approaches may be particularly appropriate ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.