A GENERAL FRAMEWORK

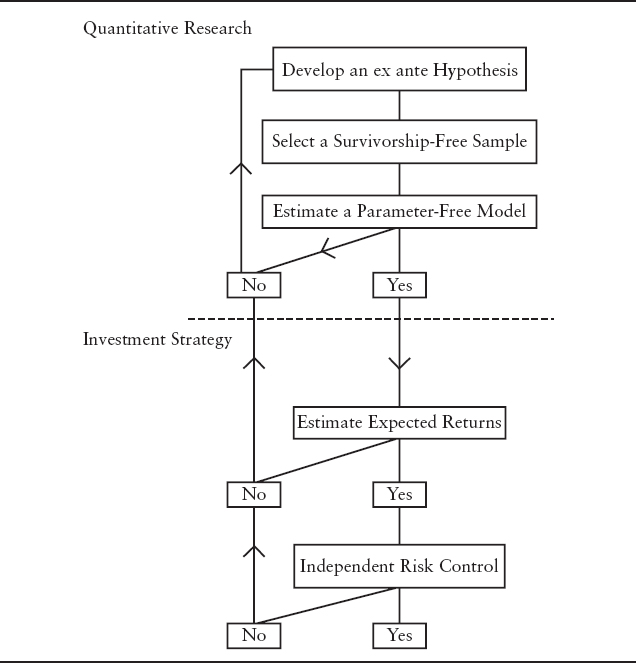

The common objective of a quantitative process is to identify any persistent pattern in the data and, in finance, convert it into implementable and profitable investment strategies. Given the relatively young life of its application to investment management, we find that there is a need to explore the general process of a quantitative procedure, and identify some of the commonly induced biases in this process. Specifically, in Exhibit 9.1, we provide a flowchart that demonstrates the process of how quantitative research is performed and converted into implementable trading strategies. Generally, it includes developing underlying economic theories, explaining actual returns, estimating expected returns, and formulating corresponding portfolios. We discuss each step in the following sections.

EXHIBIT 9.1 Process of Quantitative Research and Investment Strategy

Develop a Truly Ex Ante Economic Justification

Sound economic hypothesis is a necessary condition for the birth of an implementable and replicable investment strategy. True economics, however, can only be motivated with creative intuitions and scrutinized by strict logical reasoning, but it does not come from hindsight or prior experience. This requirement is critical since scientific conclusions can easily be contaminated by the process of data snooping, especially when a truly independent economic theory ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.