40

Real Option Valuation

Perhaps the most significant and revolutionary development in valuation is the acceptance, at least in some cases, that the value of an asset may not be greater than the present value of expected cash flows if the cash flows are contingent on the occurrence or non-occurrence of an event. This acceptance has largely come about because of the development of option pricing models. While these models were initially used to value traded options, there has been an attempt, in recent years, to extend the reach of these models into more traditional valuation. There are many who argue that assets such as patents or undeveloped reserves are really options and should be valued as such, rather than with traditional discounted cash flow models.

40.1 BASIS FOR APPROACH

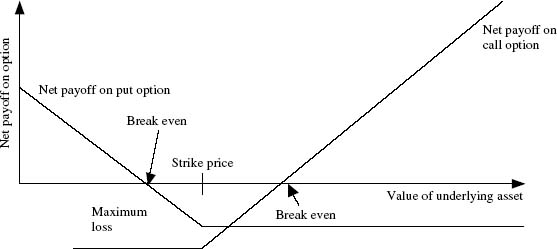

A contingent claim or option pays off only under certain contingencies – if the value of the underlying asset exceeds a pre-specified value for a call option, or is less than a pre-specified value for a put option. Much work has been done in the last 20 years in developing models that value options, and these option pricing models can be used to value any assets that have option-like features.

Figure 40.1 illustrates the payoffs on call and put options as a function of the value of the underlying asset.

Figure 40.1 Payoff diagram on call and put options

An option can be valued as a function of the following ...

Get Equity Valuation: Models from Leading Investment Banks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.