Chapter 1

Growth of Activism and Why Corporate Raiders Aren't Around Anymore

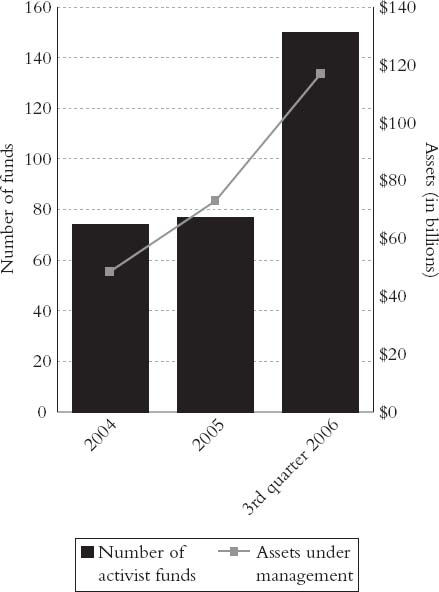

The past few years have seen a major increase in the number of activist hedge funds in the United States and abroad. As of September 2006, Hedge Fund Research Inc. (HFR), a Chicago-based database and analysis company, estimates that roughly 150 full-time activist hedge fund managers have functioning investment vehicles—roughly double the 77 activist managers that existed in 2005. Activist funds in 2006 more than doubled to $117 billion in assets, from roughly $48.6 billion in assets in 2004, according to HFR (see Figure 1.1).

Also, activists appear to have produced strong results by outperforming the marketplace over the past number of years. In 2004, when the Standard and Poor's (S&P) 500, a noted benchmark of large-capitalization companies, returned 10.86 percent, activists produced 23.16 percent, according to HFR. In 2005, activists returned 16.43 percent while the S&P 500 reported 4.91 percent. In 2006, activists produced 16.72 percent, while the S&P 500 returned 15.78 percent.

Figure 1.1 Hedge Fund Research Inc. 2006

SOURCE: Hedge Fund Research Inc.

They also are engaging and agitating for change at a wider spectrum of companies, many of which for the first time are the largest of corporations in the United States and around the world. In 2008, they prodded and engaged managers at dozens of large companies, ...

Get Extreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the World now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.