INTERNATIONAL PERSPECTIVE: AN EXAMPLE OF INTERNATIONAL FINANCIAL REPORTING STANDARDS

International Financial Reporting Standards (IFRS) are becoming increasingly important and, as we discussed in Chapter 1, are already accepted by the SEC. The consolidated balance sheet, income statement, and cash flow statement of Unilever, one of the world's leading suppliers of consumer brands (e.g., Knorr, Lipton, Dove, Hellman's), are provided below. These statements have been prepared according to IFRS, and the Unilever Group is registered in the Netherlands. Its shares are listed on the London and New York stock exchanges.

Note first that the financial statements cover up to December 31, 2008, and are expressed in euros, not U.S. dollars. While not a requirement under IFRS, Unilever's balance sheet, like many non-U.S. companies, is organized by listing non-current assets first, followed by current assets, current liabilities, non-current liabilities and, finally, shareholders' equity.

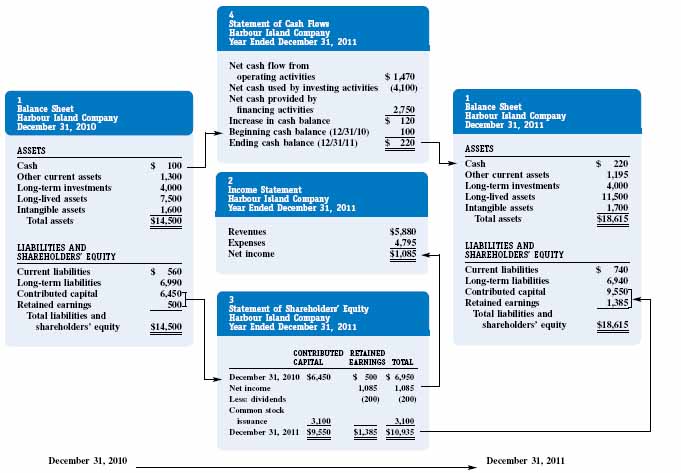

FIGURE 2-7 Relationships among the financial statements

Non-current assets + Current assets – Current liabilities = Non-current liabilities + Shareholders' equity

This format illustrates that non-current borrowings and investments by shareholders (via contributed and earned capital) provide the financing for the company's non-current assets and working capital, a relationship depicted in Figure 2-1. For the ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.