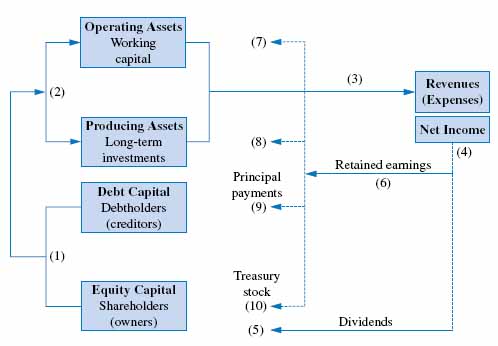

CAPITAL FLOWS AND OPERATING, INVESTING, AND FINANCIAL ACTIVITIES

Figure 2-1 illustrates the flow of capital through the firm, highlighting a number of concepts that we rely on heavily throughout the text. Management must (1) attract money, often called capital, from two sources: shareholders by selling the ownership (equity) of the firms and debtholders (creditors) through borrowings. Management normally attracts this capital by presenting historical and prospective information to these potential investors, explaining how it expects to use the capital to create returns for the investors. Shareholders (equity investors) expect returns in the form of price appreciation of their investments and/or dividends. Debtholders (debt investors) expect returns in the form of interest.

FIGURE 2-1 Flow of capital

Management invests the capital (2) in both producing assets (e.g., property, plant, equipment; other companies; intangible assets; ideas) and operating assets (e.g., inventory), often referred to as working capital. Producing assets typically provides benefits for the firm over many periods by supporting the operating activities, the management of the assets used in day-to-day operations. Managing the producing and operating assets generates revenues (e.g., sales of inventories or services), which are matched against the expenses incurred to generate them (e.g., wages and salaries), ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.